Future-Proof Your Financial Reporting (Webinar Overview ICYMI)

PRO Trial

Traditional reporting is broken.

It's time-consuming, does little to help with siloed data, and often, it doesn't provide stakeholders and leadership with meaningful insights from their reports.

The good news?

While traditional reporting may be dead, there are modern, engaging, and actionable alternatives. And they don't have to be difficult to attain either.

In our 49th webinar, Mark (Senior BI Consultant) demonstrated how finance teams can move beyond manual Excel-based reporting to create dynamic, interactive financial statements using Power BI and Zebra BI visuals.

It's much easier than you think.

Here's a breakdown of the webinar and what they discussed, but, as always, if you missed the event, you can watch it on demand, using the link below or the one on the left side of the screen.

The Problem with Traditional Financial Reporting

Over 60% of finance teams spend more time collecting data than analyzing it, leaving little room for strategic decision-making. Manual processes often lead to extended close cycles and inconsistent KPIs, causing unnecessary delays and inaccuracies.

When reports are needed most, they frequently break, adding to the frustration of finance teams. The heavy reliance on tools like Excel and PowerPoint creates version control chaos, making collaboration difficult and time-consuming.

Additionally, static reports offer limited insights, rarely going beyond basic numbers. This lack of depth can hinder a company's ability to make informed, forward-thinking decisions.

Native Power BI Limitations

While Power BI offers improvements over traditional tools, the presenters identified several limitations for financial reporting:

- Lack of Advanced Variance Analysis

- Limited Customization of Visuals for Financials

- Inadequate Support for Visual Storytelling and Comments

- Complexity in Managing Financial Hierarchies

- Lack of IBCS Compliance

- No Built-in Support for Dynamic Formatting Based on Data Context

- Limited Visual Options for Hierarchical Data and Multi-level Subtotals

- Limited Flexibility in Adding Quick Calculations

The Solution: Three Core Principles

As part of the solution provided for outdated reports, Mark outlined three fundamental principles for future-proofing financial reporting:

1. Govern and Secure Data for Auditability and Trust

Ensure data traceability and compliance while maintaining audit readiness through proper data storage. By doing so, you can build organizational trust in financial reports.

2. Automate and Standardize for Accuracy and Efficiency

Reduce manual workload and human error by streamlining processes and enabling real-time data in financial reporting. This approach helps create consistent workflows, resulting in faster and more efficient reporting cycles.

3. Make Reports Actionable with Better Communication

Implementing IBCS standards can significantly enhance the readability of your reports and presentations. By using variances and commentary effectively, you can provide clearer insights while making complex data more accessible to a wider range of stakeholders.

Evidence shows that adopting IBCS standards leads to tangible improvements, including a 46% increase in analysis speed and a 61% boost in decision accuracy. These benefits demonstrate the value of IBCS in driving better understanding and more informed decision-making.

The good news is tools like Zebra BI can give your Power BI the boost you need to easily implement additional visualization features, without much hassle, and with guaranteed, IBCS-standardized results.

The Advantage of Zebra BI Features

As shown in the webinar, Zebra BI visuals enhance standard Power BI functionality and help teams make the most out of their data and reports.

Some of the Zebra BI features you should consider incorporating in your reports include:

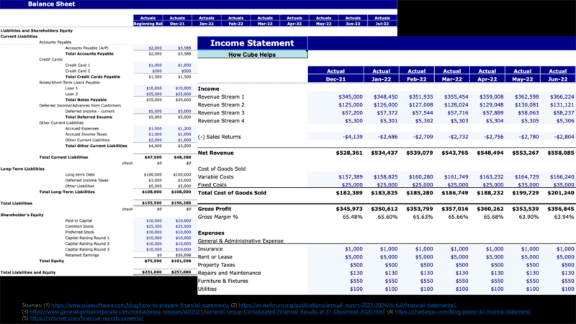

Table Visuals

Tables are great for high information density, when you need to do structural breakdowns in a clear and accurate way

The Zebra BI tables for Power BI come with additional features like:

- Built-in variance analysis with automatic formatting

- Dynamic P&L statement generation with drag-and-drop functionality

- Expandable hierarchies with subtotals

- Commentary integration at multiple levels

All of these features will help you save time, work more efficiently, and achieve your goals faster.

Chart Visuals

Although tables are the de-facto best way to present financial data, there are instances where you may want to be more selective of what you show in your reports.

Inherently, charts are great for visualizing complex data, identifying trends, and placing information as part of a story, rather than presenting it in isolation.

Zebra BI helps you turn Power BI charts into actionable visualizations of your financial data, by providing you with options that allow you to select what is seen:

- Time trend analysis on horizontal orientation

- The possibility to choos from multiple chart types: waterfall, plus-minus, action dots, small multiples, bridge charts, and so on

- Automatic switching between actual vs. plan and forecast vs. plan comparisons

- CAGR (Compound Annual Growth Rate) annotations

- Dynamic period switching (month-to-date, year-to-date, full year)

Excel & PowerPoint Are Not Dead

Let's make this clear: both Excel and PowerPoint have their parts to play in the grand scheme of things.

Excel and PowerPoint still hold significant value, but they should no longer be treated as primary tools for robust data storytelling or analysis.

Excel is fantastic in ad-hoc analysis when connected to a semantic model, eliminating the inefficiencies of working with disconnected files. Yet, with Power BI, users can export structured data seamlessly into Excel, enabling deeper analysis without compromising consistency.

Moreover, embedding live Power BI visuals directly into PowerPoint presentations further enhances their impact, transforming static slides into dynamic, data-driven narratives. These integrations ensure a single source of truth is maintained while providing the flexibility required for various analytical and presentation needs.

Live Demonstration

We couldn't let this webinar fly without a proper demonstration of how modern CFOs can meet all the expectations of their jobs and deliver actionable, data-driven insights.

Mark showcased it all:

How to Gather & Connect the Data

As you may know, Power BI data connectors allow you to quickly connect to a variety of data sources in just one click. While this step is very easy, do make sure your data is clean and ready for analysis before connecting it to your Power BI.

How to Go About Data Modeling

Once you have your data in Power BI, it is time to lay a solid foundation by creating a clean, reusable data model.

- Build account hierarchies and manage time intelligence (MTD/YTD, etc.)

- Add calendar tables and set up robust star schemas

- Integrate meaningful commentary for better context

You can learn more about data modeling from any of our guides and Help pages here, by the way:

Want to learn how to build a data model in Power BI for actionable reporting? Here's a video you may want to check out:

How to Successfully Visualize Your Data

To drive better insight from your financial reports, in an easier and quicker way, you can use Zebra BI to create advanced tables and charts, going beyond native Power BI visuals.

- Build flexible financial statements, compare Zebra BI Tables vs. Power BI’s native matrix

- Use a range of visual types: Waterfall, plus-minus, action dots, small multiples

- Calculate and display KPIs such as gross/operating margin in real time

- Efficiently explore and explain data with slicers, view changes, and annotations

- Collaborate via comments and the formula editor

How to Make Reports Shareable & Collaborative

Last but definitely not least, once your report is ready and your data is clearly visualized, it is time to empower teams to interact. Zebra BI enables you to:

- Use annotations (comments, CAGR), change views, and export results to Excel

- Collaborate easily with dynamic comments and the formula editor

Want to see these two superstars going into the nitty-gritty of using Power BI and Zebra BI to create actionable financial reports that allow you to switch from tables to charts in seconds, so you can paint the full picture to other stakeholders in your organziation?

Conclusion

Long gone are the days of CFOs having to simply share numbers.

The office of the modern CFO is far more complex than that, with Finance experts and leaders expected to:

- Ensure robust governance practices through centralized financial data management.

- Enhance clarity with transparent, standardized reporting accessible across all teams.

- Foster seamless collaboration in a secure, cloud-native environment designed for scalability.

Mark showed you how to do this in the least headache-inducing way there is: by combining Power BI's data integration capabilities with Zebra BI's specialized financial visuals. This match made in Heaven helps organizations create automated, standardized, and scalable reporting systems that meet the demands of modern finance teams.

The transformation from manual Excel-based reporting to automated, interactive dashboards represents more than a technological upgrade—it's a fundamental shift that enables finance teams to focus on analysis and strategic decision-making rather than data collection and formatting.

It's not about fancier charts and tables. It's all about modernizing your Financial department to reap all the benefits of using the latest tech in your analysis and reporting:

Efficiency Gains

- Shorter month-end closing times

- Reduced reconciliation errors

- Improved accuracy in financial numbers

- Elimination of manual copy-paste operations

Enhanced Decision Making

- Faster analysis capabilities

- Better cross-departmental understanding

- Real-time insights for strategic planning

- Improved audit trail and compliance

Scalability Benefits

- Reusable templates across business units

- Standardized reporting across global teams

- Cloud-native security and access control

- Support for growing data volumes

Ready to give it a try?