Live interview with Andrej Lapajne: What’s the Future of Reporting and the Job of a Controller?

Standards in reporting are crucial not just for saving time, but for extracting the insight and acting upon it as well. This helps the management with supporting decisions, which is crucial for running a successful business. But what about the future of reporting? Where is it heading to the following years and how will controllers need to adapt to it?

We were recently a part of an event where the Zebra BI CEO & Founder, Andrej Lapajne, had a captivating discussion about the future of reporting with IBCS standards. He spoke to Simone Verza, a contributor of Il Controller risponde (it translates into The Controller Answers), that also organized this interview. We edited their conversation to highlight the most interesting parts and make it easily digestible for you to read.

After a brief introduction about Andrej’s career path the discussion quickly moved on to tackle the focused topics. Let's dive in!

Simone: How important are the standards of reporting? How important it is to have them? We’re talking especially about IBCS.

Andrej: I believe standards are crucial.

If you type the keywords “dashboard” or “report” into Google, you will see that you get so many different styles of dashboards and reports that people are using. For example, they’re using colorful pie charts, line and bar charts, and every dashboard looks completely different with different colors.

Then you try to understand and extract the meaning of the data. You see the dashboard and your sales or financials for the month of May. When you take a look you see all of those charts, colors, everything! But do these tell you if this month was good or bad for our business? And how good? How bad? And why was it good or bad?

Typically, you don't get these answers, or you have to read through all the numbers and labels. That’s why I think it's extremely important that we have a standard that first ensures that the pictures that we are seeing are really understandable. The managers don't have the time and they want to see a dashboard and get immediate answers. Okay, we are 5% above the plan, perfect situation. Or, oh, we are 30% below the plan.

The next question is: why? They need to see immediately that it's because one business unit is so much below the plan or there's a production location somewhere where something is not according to the plan. Or some growth rates are going down compared to the previous year, and so on.

The management needs to understand this, and they need this really quickly. If you want to make sure that people actually understand the reports they’re looking at really fast, you need to do it in an intuitive way. People need to understand the charts - if something is good it's green, and if it's bad, it's red. It should be very simple to understand.

The second thing is consistency. I'm a manager, and I could get 10 completely different reports from people who report to me: long tables done in Excel from my accounting, or maybe 50 pages of some printout report with phonebook style reports. Then I could be getting completely different reports from marketing, let’s say some pie charts. The list goes on.

I waste all this time in order to understand them all. The consequence of the above is that managers don't read the reports. They have a 50-page report and they just turn to page 32, because they know there will be one number there and they read their number. The danger is that because they don't get the insight, they don't really see certain things that might be in the data somewhere in the report.

But it's not just about saving time.

Saving time is nice, but the major benefit is extracting the insight and understanding what’s going on in your business on enough detailed level that you can act upon it. If this is done correctly, then this is how the reports will become very, very actionable. You will know every important detail. “This month, this went 33% down.” Then you’ll ask yourself: why is this happening? You then might have a short, dynamic comment on it, somebody wrote something about it, or you can drill through, do it dynamically, explore what's going on, and then you understand the situation.

In this case, you have the possibility to act immediately. "Okay, this is our problem, what are we going to do about it?" And you start the action.

That's when the data actually turns into action. Here you actually get the return on investment from any BI or reporting system.

Simone: In the end, the aim of reporting is to support decisions. If we have 100 pages of reports and just one number is valuable inside of it, something is wrong. There’s a lot of work behind producing these pages.

Andrej: Each month, you copy and paste those numbers, and you make sure you stick to the timeline. You deliver these by the 10th of each month, you send them forward and you just hope that all the numbers are correct, right? And you were just dealing with the numbers.

Controllers are highly educated people who know most about business in a company. They know a lot about the processes, how things run, how they are calculated, and so on. And then they are forced to spend about 30% or 20% of their time just copy and pasting some data and not really analyzing it.

What’s happened during this period? What should we do about it? Controllers should be focusing on suggesting some actions. The highest level of reporting is actually suggesting, making recommendations for taking different actions. Then the management decides.

Andrej: Well, sure. This has been a trend for quite some time. Maybe even already from the late '80s, or especially in the '90s. We’re definitely transitioning from static into dynamic reporting, and then further from dynamic into automated reporting and artificial intelligence, data science, etc.

The trend is very clear, but the adoption is still quite poor. I believe that in the future reporting will definitely be dynamic. Not just automated in the sense that you can report dynamically in a dashboard when you see what's going on, and that you drill down to get the details immediately. Or drilling through to another page with a lot of details and techniques that are already a standard, I would say, in a typical BI tool.

I also have in mind the reporting being dynamic so that both software and software solutions will actually search for certain patterns in the data and will dynamically change the views based on what is really happening in the data and will try to provide us with some automated insights. For example with some interesting patterns in the data and outliers.

They will try to provide this in a user-friendly way with good visualization, which is one path that I see in the future. For example automated visualization or maybe also in other means that are close to human beings like our natural language. The software could actually write a report with words in English, for example, or hopefully also in Italian or in Slovenian!

Simone: Why not?

Andrej: The future of reporting is definitely dynamic, but we also need to adapt to the processes. If you just take a look into the past - Excel offered pivot tables. This was probably the first practical dynamic reporting feature, right? But how many people have actually used pivot tables up until recent few years? I mean, they were probably there from the '90s, right?

People still have their cell-based reports, copy and paste their plan or the actuals each month, and combine something, and have thousands of lookup formulas with all manual processes. Then they export data somewhere and then import it through files.

It's all still complicated in real-world situations. That’s why we need to do a lot to streamline all the processes to make sure that the data is connected. It's not just what the technology can do right now, because the technology can do amazing stuff already. It's the whole process where it goes from your old into this fancy new system? How do people adapt to it? It also takes the change in the skills that people need or require. So it's also a lot of change management.

Simone: I think there is still a cultural gap in this field because the technology is sometimes running 10 times faster than the adoption of it in the companies. There are many reasons for it. It‘s not just the cost, it’s also, as you said, the skills of the people, and managing all this. If you change something, you then maybe have to adapt loads of other things, too. That’s slowing down the adoption of these new tools.

Andrej: That's one of the reasons. But sometimes the software is the reason, too. When new technologies come out, and especially if those technologies are driven by big companies like IBM, Microsoft, they often neglect the user factor. So you have this brilliant algorithm, but it's so user-unfriendly that you need 10 IT people to set it up and connect it. I think that's a major hurdle. These tools should be so user-friendly that you can take them in your hands and just work with them, and you just forget what's behind them, and so on.

The tool should help us, rather than we should study it profoundly and have a team of people and a project of two years to implement it. I also think the mentality of bigger software companies and just software producers, in general, has to shift towards a much better user experience and user interface. Designers of software have to think more about who is using it, and they have to realize that they are doing this for real people. What’s the process? How many clicks does it take for a user to get something out of the software?

Simone: Before carrying on, we already have two questions from the audience. Paolo is asking us: becoming a business partner for finance, people control is key for adding value. What suggestion can you give to go deep in this direction?

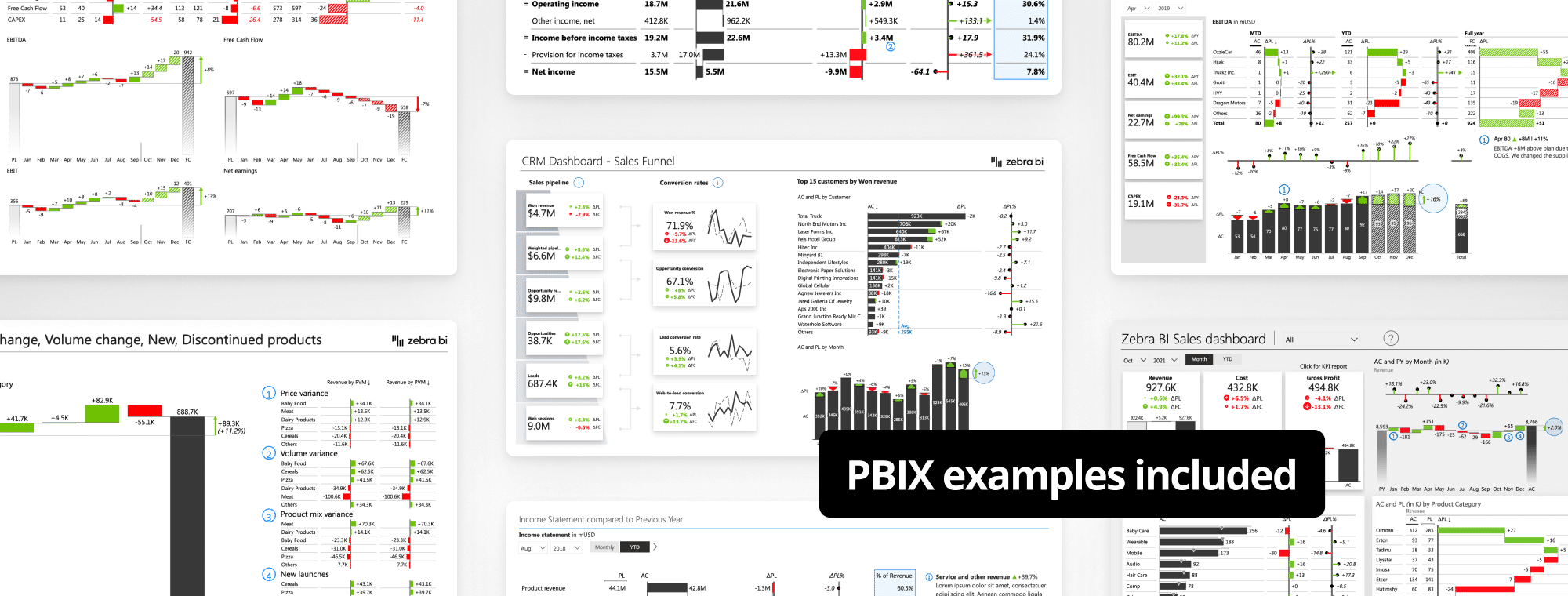

Andrej: It's a very important question because this is exactly what a controller should be. If the controlling is done right, then the controller is definitely the partner for the management directly and reports to it directly. I would say first, make sure that you're not spending too much time on tasks that, like we were discussing, you’re copy-pasting data and so on. Invest into automating reporting. For example, that you can click every month and you get new data without manual processes, or even without clicking. Implement tools like Power BI, and tools that can already automate the process of getting the data into the system, that can automate reporting, and so on.

Of course, Zebra BI is also one of the tools that will help you with that. But it's about the whole process. So if you automate this, then you will have much more time for communication. If you want to be a successful business partner to the finance or to the management board, you need good communication skills. In terms of reporting, this means learning how to write efficiently, how to structure the reports, how to write short, efficient comments, so just basic writing skills.

Going beyond that, how do you do the visual storytelling? How do you do it interactively with dynamic reporting? How to teach the finance people or even the managers to use those tools dynamically themselves, right? Just take the time, save the time from repeating tasks, and move more into communication and visual storytelling. I would say that this is how you get the link to the management. And focus on the actual analysis and recommendations to the management.

Simone: There‘s another question. How do you see the users of BI reports and their data skills in terms of gathering insights from them? For example, the viewer here says that he talks to clients and he sees some details that the client previously didn’t notice.

Andrej: This brings it all back to the original discussion we had. The IBCS standard can definitely help here.

First, the consistency. If you're doing it, in the same way, each month, and each user creates a report that looks similar and uses the same definitions... This is actually the core of the IBCS standard. You use the same colors and same shapes for the business entities or business elements that have the same meaning. If you have variances, they're always red and green, for example. And if it's a ratio or something, it looks different than the sales in million euros, and things like that.

The same goes for the terminology of the report. If you can make them the same for each meaning, and make sure that everybody who is producing reports uses the same notation, the same standard. The people who will read those reports will actually understand them because they will all be speaking one language. It's easy for us to communicate because we are talking in English. But if we would all be talking different languages, it would be hard having an intelligent conversation.

It's the same with the IBCS standard in reporting because it's one language, right? So you have to learn it first and you need some tools to be able to use it. But once you do, then you talk and somebody will read, and we'll listen, and we'll understand it. And people get adjusted very quickly to that.

Simone: What about data visualization and data science? I think we are moving to a future where these two disciplines are even more separated from one another. In the past, we probably had someone who was doing both; data scientists and so on. But I see that data visualization is growing a lot as topic. What do you think?

Andrej: I think you're right. Data science is somehow going its own way. At least at the moment, it's very contained and it's sort of a very separate world of data science. Data scientists are a separate team of separate people using separate tools. It's still not very integrated, both with tools and especially within the organization.

I don't know any company that would have data scientists in the controlling department. However, in terms of data visualization versus data science, I would say they overlap a little bit. It's two different fields.

Data visualization is a more general field of just visualizing data. You can - of course - visualize data in reporting, in business intelligence, you can visualize data in data science as well. So data visualization is definitely a part of data science. But data science is also algorithms, and methods, and approaches that are more close to statistics, and more and more, of course, machine learning and other artificial intelligence methods.

It's a world where people use more advanced algorithms and machine learning techniques. In the end, they still need to produce results, so they need to visualize it. I would say that visualization in data science is typically a little bit different. It's a little bit of its own world again, which I think is a process where things will converge in the end.

It's still a very young data field, which in my belief, should sooner or later get integrated into other processes in reporting, controlling, and so on. That's my guess, but we'll see what the future brings.

Simone: We already briefly spoke about the role of the controller. To sum up, what will all this affect the role of the controller?

Andrej: It's hard to tell the future, but from the trends that I see, all the processes will get automated much more than they are now. Machines and algorithms will do a lot of work that humans do at the moment. The processes that are manually very intensive will slowly get replaced by algorithms and software and bots and robots. I would say practically, in controlling and reporting, this means that the basics like data flows and generation of reports and even generation of visuals will get automated for sure.

Automatic visualization is also a thing of the future. These methods and tools will somehow converge and will become just smart tools that will help you gain some insights and do the initial analysis.

I think the tasks of a controller will shift towards the things that humans can do very well and machines can’t. This is still creative and intuitive thinking and communication, which means understanding the situation. Of course, we will have a much better understanding, because the machines will select the most interesting data parts or data categories.

Machines will help us gain a better insight, but it’s going to be even more important for us to be the communicators, analyzers and presenters, maybe storytellers, and the things that are inherently human. My prediction would be that a job of a controller in the future will tend towards that.

Simone: Communication is quite a hot topic, too. We are working hard to create the reports, but there’s not a lot of work invested in communicating the outcome.

Andrej: Exactly. That's also my thought. Marketing guys were trained for communicating, but in the financial world, nobody is teaching us those skills. Even when I was a consultant, I sometimes found this part challenging.

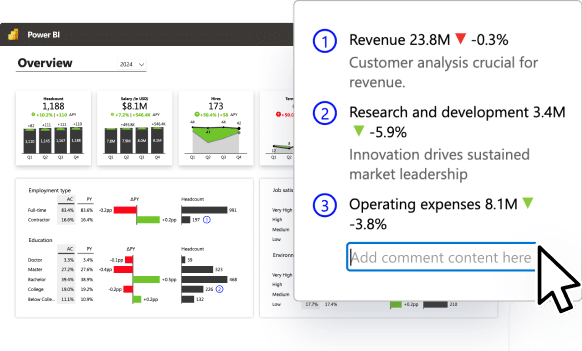

Even nowadays, for example, if the visualization is automated with Zebra BI, and you don't have to manually create a new picture every month, even then the controller delivers and writes messages that are already included in the report. Controllers are still writing things like: in the year 2021, the profit margin went up by 3.5% because of this and that.

They would just be describing the facts that were already there in charts or in tables. But this isn't something that's an added value. What humans can add is additional insights and making sure that the right emphasis is made on the right parts of the business where the management should focus on or take action.

And this is what I think is the core that will sort of remain in the future for the controller to do, and this will be very hard for a machine.

Simone: Hopefully, I would say – because otherwise, we are jobless?

Andrej: I don't think people will be jobless, but we will definitely need to refocus. It's like building a house. Thousands of years ago, you had to do it with your hands from mud or make some bricks and lay them out and, you had to do everything. But now machines can help you. So it's easier, right?

You need to have a good tool, of course. So I don't think people will lose jobs for that, but they will have to refocus and gain some other skills for sure.

What do YOU think? Do you think technology could also make a job of a controller harder in the future? Let us know in the comments below 👇

Before you go, we'd like to invite you to watch the full interview here:

September 8th

September 8th February 22nd

February 22nd