How to manage working capital in times of COVID-19 crisis?

A number of companies now face weeks, if not months, of exceptionally poor trading conditions. For most, the revenue lost in this period represents a permanent loss rather than a timing difference.

All this is putting sudden, unanticipated pressure on liquidity.

Revenue is vanity, Profit is sanity, but Cash is king.

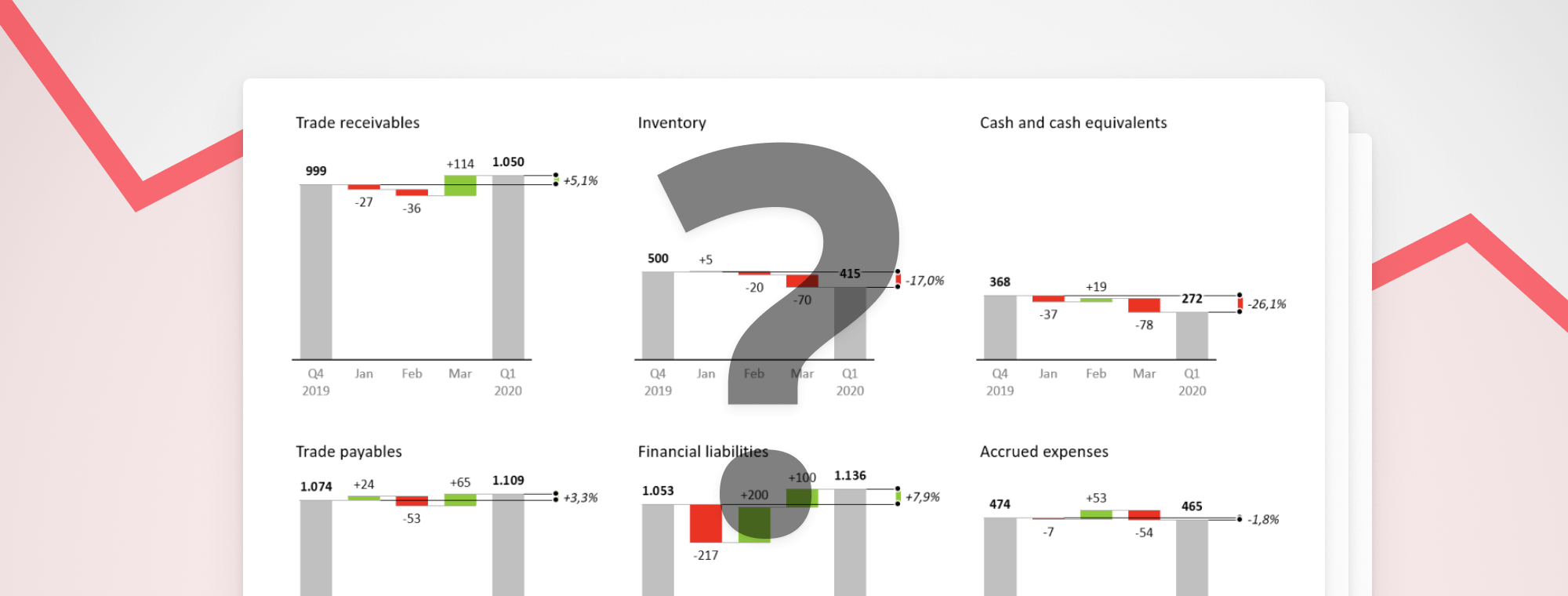

We need to urgently shift our focus from the income statement to the balance sheet with a spotlight on working capital. For this reason, we prepared a comprehensive set of working capital management strategies to overcome the economic threat of COVID-19.

We believe that understanding and focusing on working capital management is crucial for companies to stay afloat during the economic crisis triggered by the COVID-19. Even businesses that appear to be in good financial shape may not be immune.

Doing nothing is the worst option.

“We were always focused on our profit and loss statement. But cash flow was not a regularly discussed topic. It was as if we were driving along, watching only the speedometer, when in fact we were running out of gas.”

—Michael Dell, founder and CEO, Dell Technologies

Who will suffer the most?

The most impacted industries regarding profitability and short-term liquidity are Tourism & Travel, Airlines, and Retail (excluding food retail).

We explain why and offer additional insights, examples, and potential outcomes.

7 must-follow strategies

Even for companies that have not yet been adversely affected, we recommend they seek to improve cash flow. There are 7 practical steps every company should follow to survive.

Ratio Analysis

We measure Working Capital through ratios and financial KPI’s, but if we want to improve those KPI’s, we need to optimize the underlying process.

September 8th

September 8th February 22nd

February 22nd