How to Create a Profit and Loss Statement in Power BI

PRO Trial

Profit and loss statements, also known as income statements, play a crucial role in assessing a company's financial health. They provide a detailed summary of a company's revenue, expenses, and net profit or loss over a specific period of time. Creating and analyzing profit and loss statements can be a complex task, but with the help of Power BI, a powerful business intelligence tool developed by Microsoft, this process can become more efficient and effective.

Understanding the Importance of Profit and Loss Statements

Profit and loss statements are vital for businesses of all sizes because they provide valuable insights into their financial performance. By analyzing these statements, companies can identify areas of growth, spot potential issues, and make informed decisions to improve profitability. Profit and loss statements serve as a benchmark for assessing a company's financial health and are often used by investors, creditors, and other stakeholders to evaluate the company's viability and profitability.

The Benefits of Using Power BI for Financial Analysis

Power BI offers numerous advantages for creating and analyzing profit and loss statements. Firstly, it integrates seamlessly with various data sources, allowing users to import financial data from multiple systems effortlessly. This capability enables businesses to consolidate information from different departments and systems into a centralized platform, making it easier to perform in-depth financial analysis. Additionally, Power BI provides powerful visualization tools that allow users to transform data into interactive and visually appealing reports, enabling a more intuitive exploration of financial insights. Furthermore, Power BI's advanced data modeling features, such as DAX formulas, enable users to create complex calculations and measures to enhance the accuracy and depth of their profit and loss statements.

Getting Started with Power BI: A Quick Overview

Before we delve into creating profit and loss statements in Power BI, let's take a quick overview of the platform. Power BI is a cloud-based business analytics tool that enables users to connect to multiple data sources, transform raw data into meaningful insights, and share reports and dashboards with colleagues and stakeholders. With its user-friendly interface and powerful capabilities, Power BI has become a popular choice for financial analysis and reporting.

Step-by-Step Guide to Designing a Profit and Loss Statement in Power BI

Now that we have an understanding of the importance of profit and loss statements and the benefits of using Power BI let's dive into the step-by-step process of creating a profit and loss statement. The first step is to gather the necessary financial data from various sources, such as accounting software, spreadsheets, and databases. Once the data is collected, it must be imported into Power BI and cleaned to ensure accuracy and consistency. Power BI provides various data transformation tools to perform tasks like filtering, sorting, and aggregating data.

After the data is cleaned, the next step is to design an effective visualization representing the profit and loss statement. Power BI offers a wide range of visualization options, including charts, tables, and slicers, allowing users to choose the most suitable format to present their data. Selecting visuals that convey the desired information clearly and concisely is important. Users can customize the visuals by applying formatting options, adding labels, and defining colors to enhance the visual appeal and readability of the profit and loss statement.

Choosing the Right Data Sources for Your Profit and Loss Statement

When creating a profit and loss statement in Power BI, choosing the right data sources that provide accurate and relevant information is essential. For instance, financial data can be sourced from accounting software, such as QuickBooks or Xero, which often have built-in integration options with Power BI. Spreadsheets, such as Microsoft Excel or Google Sheets, can also serve as reliable data sources. Additionally, external databases or APIs can be used to import financial data into Power BI. It is important to ensure that the chosen data sources are reliable, up-to-date, and cover all the necessary revenue and expense categories required for the profit and loss statement.

Importing and Cleaning Financial Data in Power BI

Once the data sources are identified, the next step is to import the financial data into Power BI. Power BI provides intuitive data import features that enable users to connect to various sources and import the data with just a few clicks. Users can establish connections to data sources, specify settings such as filters or transformations, and import the data into Power BI's data model. Once the data is imported, it must be cleaned and transformed to ensure accuracy and consistency. Power BI's data transformation tools allow users to perform operations like removing duplicates, filtering out irrelevant data, and handling missing values. Cleaning the data ensures that the profit and loss statement is based on reliable and accurate information.

Designing Effective Visualizations for Your Profit and Loss Statement

The design of the profit and loss statement in Power BI is a crucial aspect that determines its usability and effectiveness. Power BI offers a wide range of visualization options that enable users to present financial data in a meaningful and engaging manner. Users can choose from various chart types, like bar charts and line charts, to represent revenue, expenses, and other financial metrics. Additionally, tables and matrix visuals can be used to display detailed information about individual revenue and expense categories. Users can also use slicers to enable interactivity and allow users to drill down into specific metrics or time periods. By selecting the appropriate visuals and arranging them logically, users can create a profit and loss statement that is easy to understand and interpret.

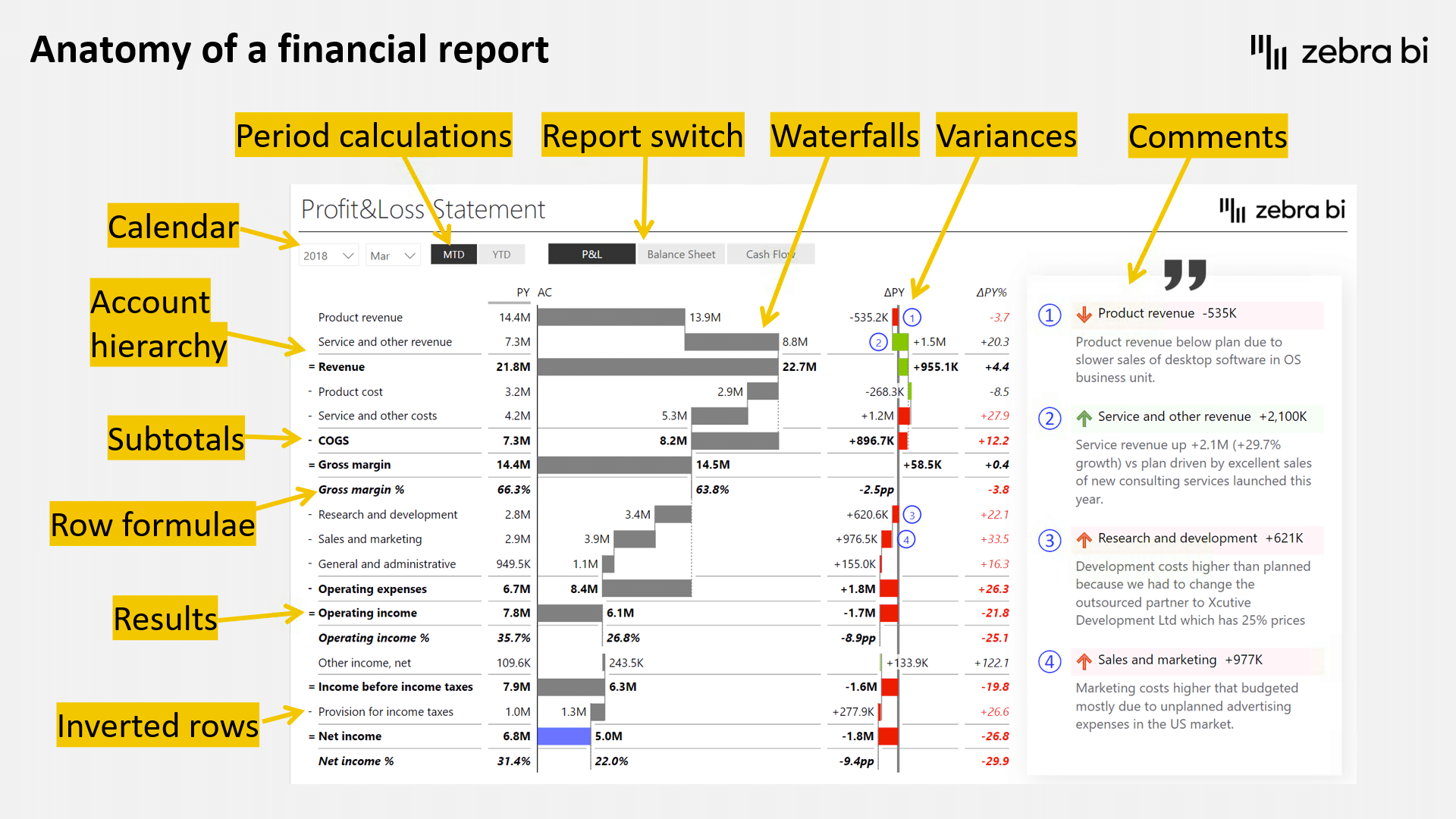

The anatomy of a financial report

So, what do you need to build something like this?

Here are the 10 things that make up this effective report:

- The calendar filter because you're reporting by month and year.

- Period calculations so you can switch between month-to-date and year-to-date views and full-year views.

- Account hierarchy is crucial for every financial report. The structure of your accounts needs to be clean, and data from several sources needs to be merged. It has to have a proper hierarchy across several levels and so on.

- Subtotals are essentially calculations of your rows. For example, the cost of goods sold comprises product, service, and other costs.

- Results are similar to subtotals but offer more. Instead of just aggregating your financial data, they are calculations. Take the gross margin row, for example, which is calculated as revenue minus the cost of goods sold.

- Inverted rows allow us to work effectively with KPIs. In financial reporting, increasing some KPIs is not good for financial performance, and that is why we use the invert feature.

- Report switch to move between different reports.

- Visualization so you don't have to rely on tables alone but can tell a story with a combination of tables and charts. In this example, we used very effective waterfall charts.

- Variances are at the heart of any business report, like the income statement. They show how your results stack against your plan, the previous year's results, etc.

- Comments are very important for financial reporting as financial reports are typically delivered to the top management, who prefer comments. They need short explanations that explain what's going on.

Analyzing Revenue Trends Using Power BI's DAX Formulas

Power BI provides a powerful formula language called DAX (Data Analysis Expressions) that allows users to define custom calculations and measures. These calculations enable users to perform advanced financial analysis and extract deeper insights from the profit and loss statement. For example, users can use DAX formulas to calculate growth rates, analyze revenue trends, or calculate key performance indicators (KPIs). By utilizing DAX formulas effectively, users can gain a comprehensive understanding of the revenue dynamics and identify any underlying patterns or anomalies.

Read and learn more: Financial Analysis in Power BI: How To Do Financial Benchmarking Right [Fortune 500 Companies Real Data Examples]

Tracking Expenses and Cost Categories in Power BI

Tracking and analyzing expenses is crucial for understanding a company's financial performance. Power BI enables users to create customized expense and cost categories that align with the specific needs of their organization. By categorizing expenses effectively, users can track individual expenditure items, understand cost trends, and identify areas for cost optimization. Power BI provides flexible options for creating expense categories, ranging from simple text fields to hierarchical structures that allow detailed expense classification. By incorporating these expense categories into the profit and loss statement, users can gain valuable insights into the cost structure of their organization.

Creating Calculated Measures to Enhance Your Profit and Loss Statement Analysis

Calculated measures in Power BI are custom calculations that users can create to enhance the analysis of profit and loss statements. These measures allow users to perform calculations based on specific requirements or unique metrics. For example, users can create measures to calculate gross profit margins, net profit ratios, or return on investment (ROI). By including these calculated measures in the profit and loss statement, users can gain a more comprehensive understanding of the financial performance of their organization.

Utilizing Filters and Slicers to Drill Down into Specific Financial Metrics

One of the powerful features of Power BI is the ability to drill down into specific financial metrics using filters and slicers. Filters allow users to select specific criteria or conditions to focus on specific aspects of the profit and loss statement. For example, users can filter data based on time periods, product lines, or geographical regions to analyze financial performance in more detail. Slicers provide an interactive way to filter the data by presenting a visual interface that users can interact with. By utilizing filters and slicers effectively, users can gain deeper insights into their profit and loss statement by focusing on specific metrics or categories that are of interest.

Incorporating Budgets and Forecasts into Your Profit and Loss Statement Analysis in Power BI

Budgets and forecasts are important tools for financial planning and analysis. Power BI allows users to incorporate budgets and forecasts into their profit and loss statement analysis by integrating these data sources into the reporting framework. Users can assess how well the organization performs against its financial targets by comparing actual financial performance with budgeted or forecasted figures. Power BI provides various visualization options, such as variance charts and KPI indicators, to highlight the deviations between actual and projected figures. By incorporating budgets and forecasts into the profit and loss statement analysis, users can gain a comprehensive view of their organization's financial performance.

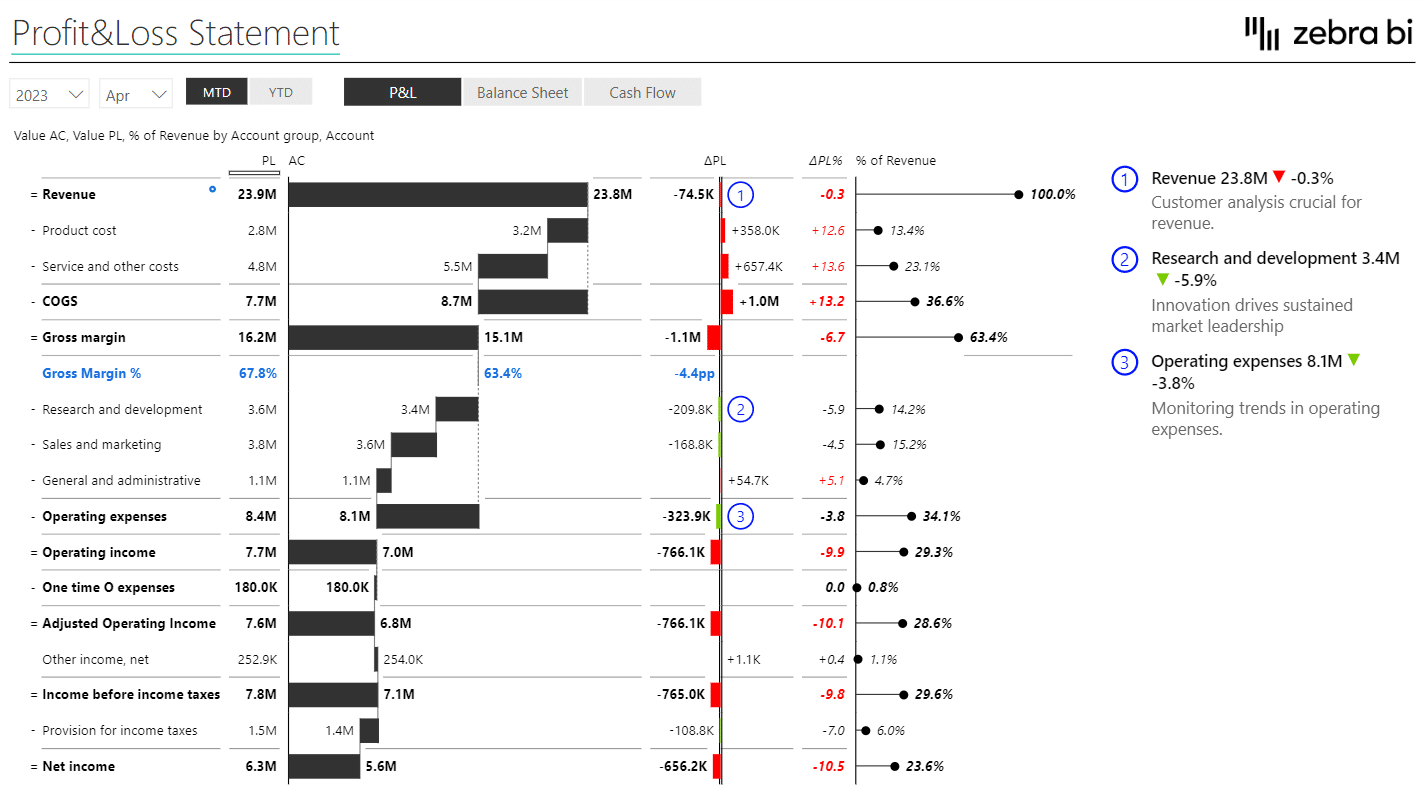

In the interactive example, you can see how variances in Profit and Loss should be presented:

The dashboard's homepage shows the AC and PL values (and the variances) of:

- Revenue

- Gross margin

- Operating income

- Income before income taxes

- Net income

It also features dynamic comments related to the above KPIs.

Zebra BI advantage: The Zebra BI Tables visual is the perfect tool for this task, and it offers a load of features, such as completely responsive design, integrated variances, and hierarchies. One of the things we're most proud of, however, is calculations. Whenever you want to add a new element to your table, and it's not in your data set, you can simply calculate it with a formula within a visual without doing any work on your data set.

Download the FREE PBIx file: Profit & Loss Statement in Power BI.

Sharing and Collaborating on Profit and Loss Statements with Colleagues in Power BI

One of the key strengths of Power BI is its collaborative features, which allow users to share and collaborate on profit and loss statements with colleagues and stakeholders. Users can publish their reports and dashboards to the Power BI service, making them accessible to others within the organization. Additionally, users can set permissions and access levels to control who can view and interact with the profit and loss statements. Power BI's collaboration features enable real-time collaboration, allowing multiple users to work on the same report simultaneously. This capability promotes transparency and facilitates effective decision-making by providing a shared platform for financial analysis and reporting.

Advanced Tips and Tricks for Optimizing Your Profit and Loss Statement in Power BI

While we have covered the essential steps and features for creating a profit and loss statement in Power BI, there are several advanced tips and tricks that can further optimize the analysis. For example, using advanced DAX expressions, users can leverage Power BI's advanced modeling capabilities to create complex relationships between tables, implement hierarchies, or define custom calculations. Users can also take advantage of Power BI's data refresh options to ensure that the profit and loss statement is always up-to-date with the latest financial data. By exploring these advanced features and techniques, users can unlock the full potential of Power BI and maximize the effectiveness of their profit and loss statement analysis.

Troubleshooting Common Issues When Creating a Profit and Loss Statement in Power BI

While Power BI offers powerful capabilities for creating profit and loss statements, users may encounter some common issues during the process. Some of these issues include data mismatch or inconsistency, inaccurate calculations, or difficulties in importing data from different sources. To address these issues, it is important to have a clear understanding of the data sources, perform thorough data validation, and leverage Power BI's debugging and error-handling features. Additionally, the Power BI community and online resources can be valuable sources of support and guidance when facing specific challenges. By being aware of these common issues and having the necessary troubleshooting skills, users can overcome obstacles and ensure the accuracy and reliability of their profit and loss statements.

Comparing Actual vs. Target Performance in Your Profit and Loss Statement Using Power BI's Analytics Features

Comparing actual performance against target or budgeted figures is an important aspect of financial analysis. Power BI provides powerful analytics features that enable users to perform these comparisons easily. Users can create calculated columns or measures to represent target or budgeted figures and then use visualizations, such as variance charts or waterfall charts, to compare actual performance against these targets. Power BI's analytics features provide insights into the deviations from the targets, enabling users to identify areas of improvement or take corrective actions. By incorporating these comparisons into the profit and loss statement, users can understand the organization's financial performance and identify opportunities for optimization.

Exporting Your Profit and Loss Statement from Power BI for External Use

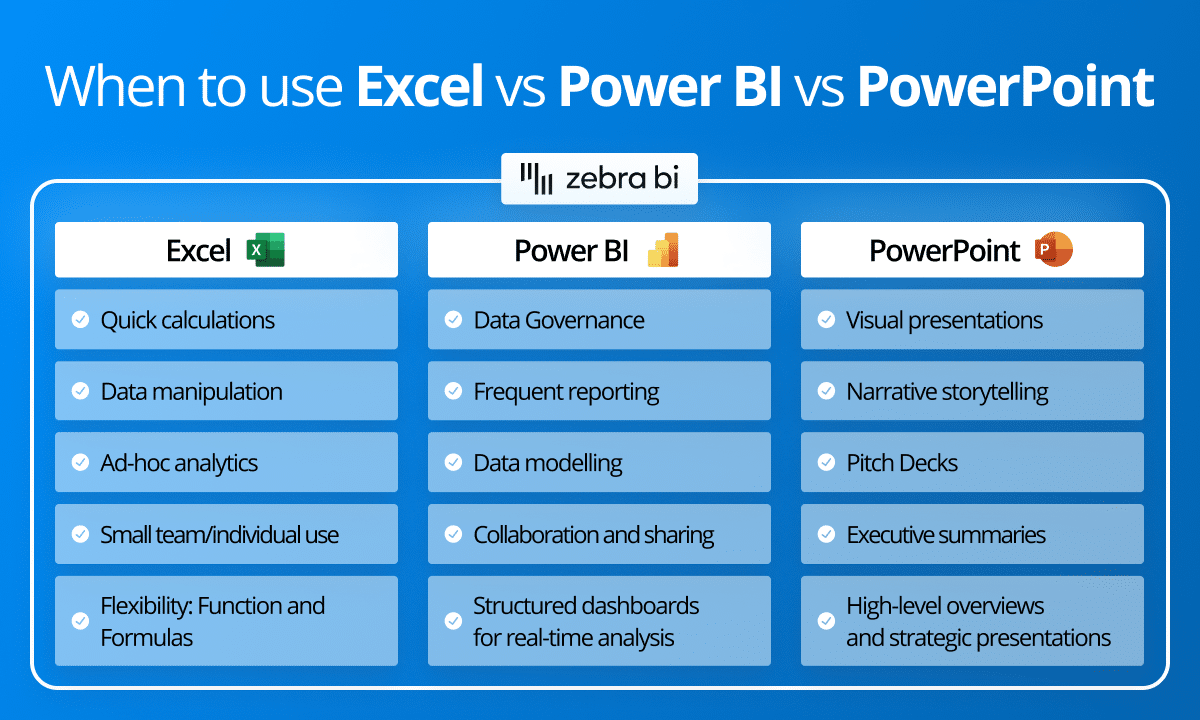

Power BI allows users to export profit and loss statements in various formats for external use. Users can export the reports as PDFs or PowerPoint presentations to share with stakeholders who may not have access to Power BI.

Additionally, Power BI's integration with other Microsoft Office tools, such as Excel or Word, enables users to export the profit and loss statement as a data table or incorporate it into other documents or presentations. By exporting the profit and loss statement from Power BI, users can disseminate the financial insights to a wider audience and facilitate effective communication and decision-making.

Note: Zebra BI is available in Excel and PowerPoint, too.

Watch the webinar

In this webinar, Zebra BI's CEO & Founder, Andrej Lapajne, will tackle all the challenges and provide tips & tricks to structure, create, and design understandable and actionable income statements with the help of Zebra BI visuals for Power BI.

(0:00) - Introduction by Andrej Lapajne

(0:50) - P&L example presentation

(5:47) – Agenda

(6:45) – Anatomy of a financial report

(11:51) – Financial data model and data preparation

(25:10) – Building a report

(29:58) – Inverted rows

(32:50) – Row Formulae

(36:12) – Creating a report slicer to switch between reports

(38:48) – Comments & Comment markers

(42:15) – KPI Trends

(55:25) – Bridge Charts

(57:50) – Wrapping up

(01:00:12) – Q&A Session

Conclusion

Creating a profit and loss statement in Power BI is a multifaceted process that requires a deep understanding of financial analysis, data modeling, and visualization. By following the step-by-step guide outlined in this article and leveraging the advanced features and capabilities of Power BI, users can create comprehensive and visually engaging profit and loss statements that provide valuable insights into their organization's financial performance. With Power BI's collaborative features, these profit and loss statements can be shared and utilized by colleagues and stakeholders, promoting transparency and enabling data-driven decision-making. Unlock the power of Power BI and take your financial analysis to the next level!

September 8th

September 8th February 22nd

February 22nd