A different way to present cash flow statement

This is a guest post by Saša Butina, a consultant at SASH Reporting. See more about SASH reporting at the end of the post.

When one monitors financial activities - inflows and outflows from the company’s bank account, he/she usually analyses and presents data in the table. It’s just something we are used to and basically, there is nothing wrong with it. We should have enough time and carefully read through cash flow statements to see clearly what is happening with our most liquid assets. Let’s be honest - in the end, cash is king and cash is what every business is about :).

But, as life is getting faster and faster we often miss the time to carefully read all reports, especially if they consist mainly of tables with lots of data. In such cases, the reader needs to really focus, understand and have good analytical skills to get to some meaningful conclusions based on reports. That is why all BI (business intelligence) solutions put more and more effort into providing good and simple options to visualize our data. The reason for this lies in the fact that most people are visual types and are able to see trends and anomalies faster from charts than from tables. Lots of companies already use different BI solutions with such options and present their business results using different charts.

Different types of charts for a different type of data

Most commonly used charts in general are:

- time-related charts, showing sales or costs or profit during different time periods, and

- structure charts showing sales structure by products or markets, costs structure by cost type, inventory structures by product, and so on.

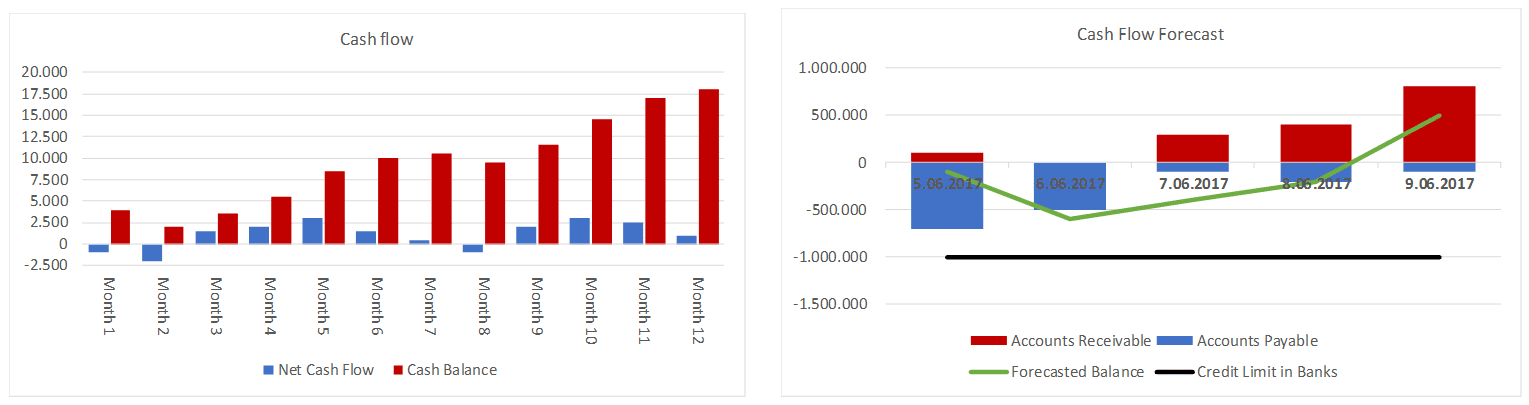

There are lots of other data commonly presented in charts but we rarely see cash flow statement data presented in any type of chart. Even if we do, such charts usually are not very user-friendly. You can see a few examples of such charts below where it is not clear what the message of each chart is. These charts are not easy to read and therefore do not bring added value compared to data presented in tables.

When we present cash flow or any other data in charts we should make sure that:

- the message we want to deliver is clear and understandable,

- we use colors that the reader instinctively knows they mean,

- we give the reader some recommendations on future actions/decisions.

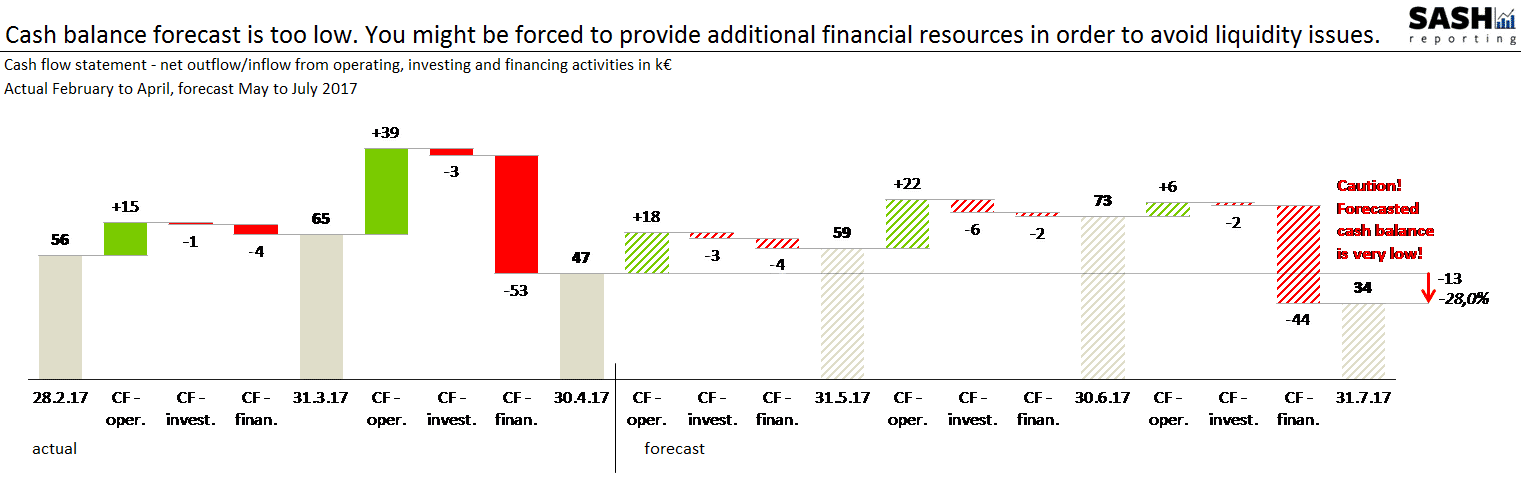

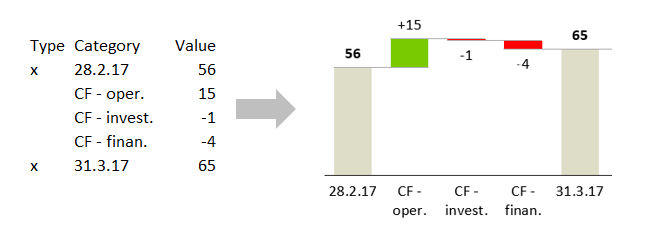

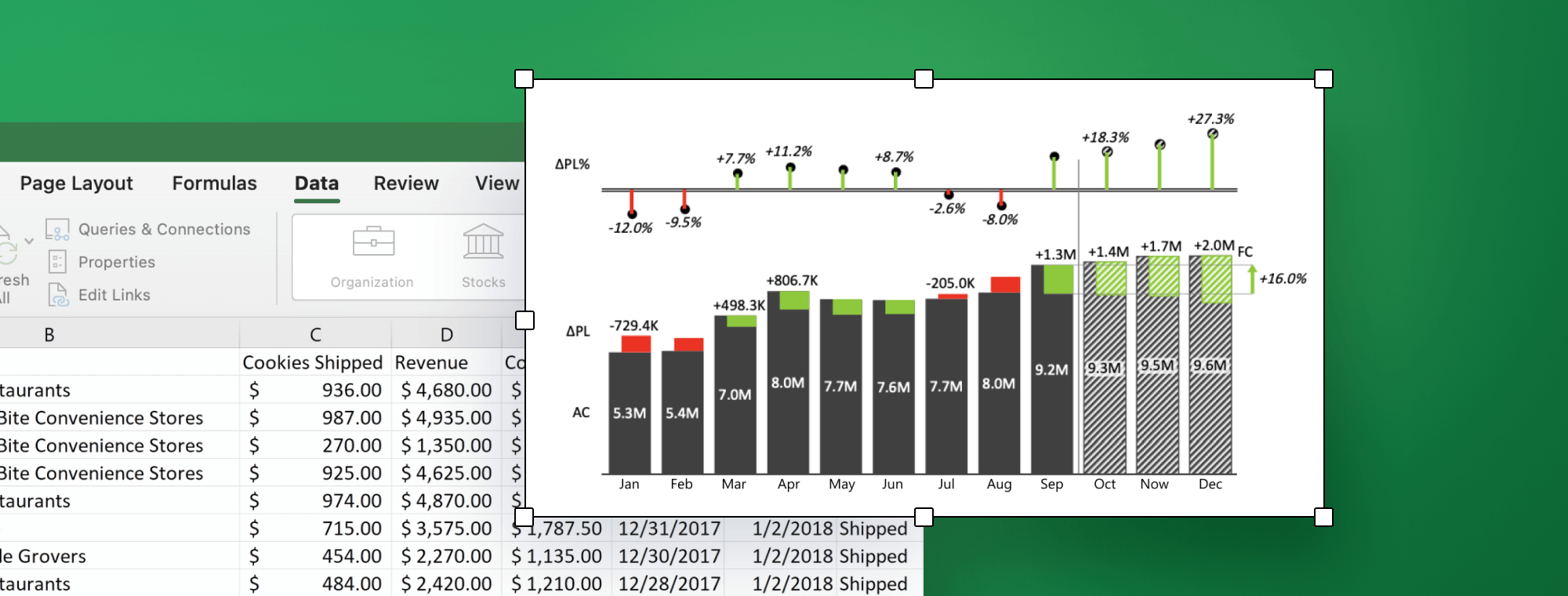

In other words – the reader should get the message with one look at the chart and quickly know what to do next. Let’s take a look at the chart below to illustrate our point.

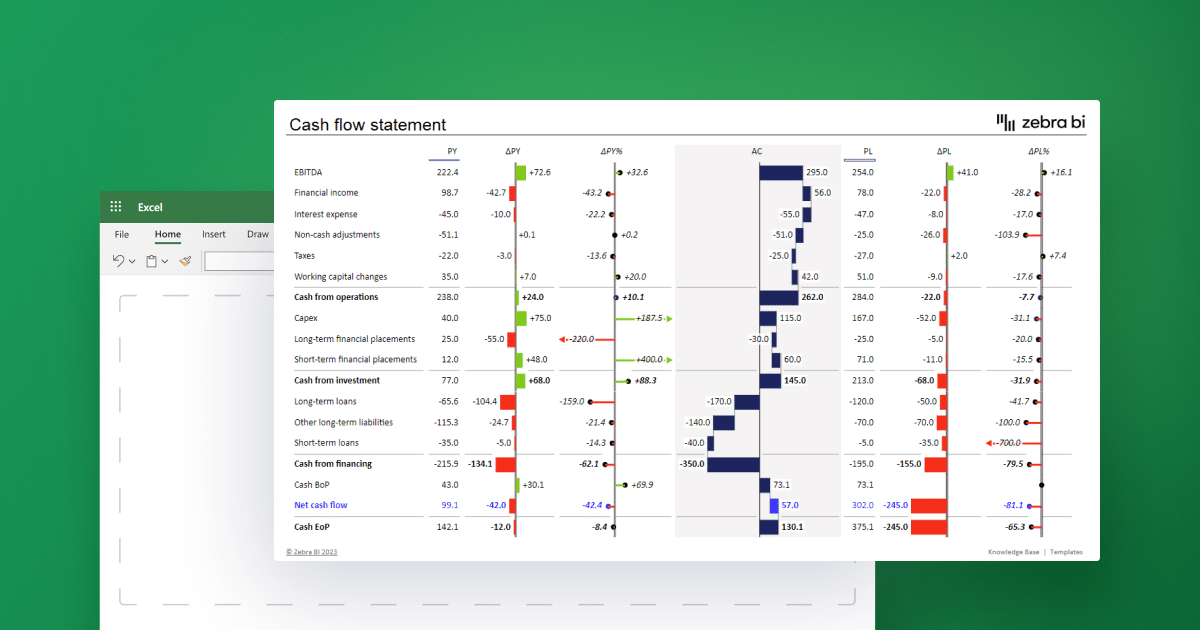

Cash flow statement presented with contribution chart

To explain this chart, we should start with grey bars, which present the cash position at a certain point in time (end of each month in this case). We can see, that at the end of February 2017, the cash position was 56k€, at the end of March it was 65k€ and at the end of April it was 47k€.

Note: In the chart above the selected period is a month, but we can also show data weekly or even daily. It depends on data we have available and which we want to look at.

Further, let’s explain the green and red bars in between. They present net inflow (green) or outflow (red, obviously :)) from different types of business activities.

- Cash flow from operating activities is one generated by the company’s core business operations (receivables collection, wages, and payables payments).

- Cash flow from investing activities is the one generated from buying or selling equipment, assets, or financial investments (for example shares in other companies).

- Cash flow from financing is mainly generated from debt, loans, or capital changes.

The chart shown above was created at the beginning of May 2017, while the last actual date was the end of April 2017. The left part of the chart presents past actual data and the right side of the chart is reserved for presenting forecasted cash flow for the next three months. "Forecast" bars are stripped while "actual" bars are colored fully – so you can immediately see what is actual and what forecasted data. On the far right side of the chart you also see the red arrow pointing down and two numeric data. These are showing the difference between the last actual cash position to the last forecasted cash position. The difference is minus 13k€ which means 28%. It is quite a lot and a cash position in the amount of 34k€ is not enough for this company to avoid liquidity issues. Therefore, you can also see red caution alert above the grey bar.

The general rule for services companies is that cash position in every point of time should not be less than the amount of three months costs.

Three questions that come to mind

- How do we prepare such a chart, technically?

- How do we prepare cash flow data that is used to prepare such chart?

- How do we prepare a cash flow forecast for the next three months?

1. Preparing cash flow contribution chart technically

To prepare such chart you need Excel, plenty of Excel skills, and plenty of time. 🙂 Even though Excel 2016 introduced waterfall charts, the default Excel waterfall chart is still too limited for advanced cash flow analysis.

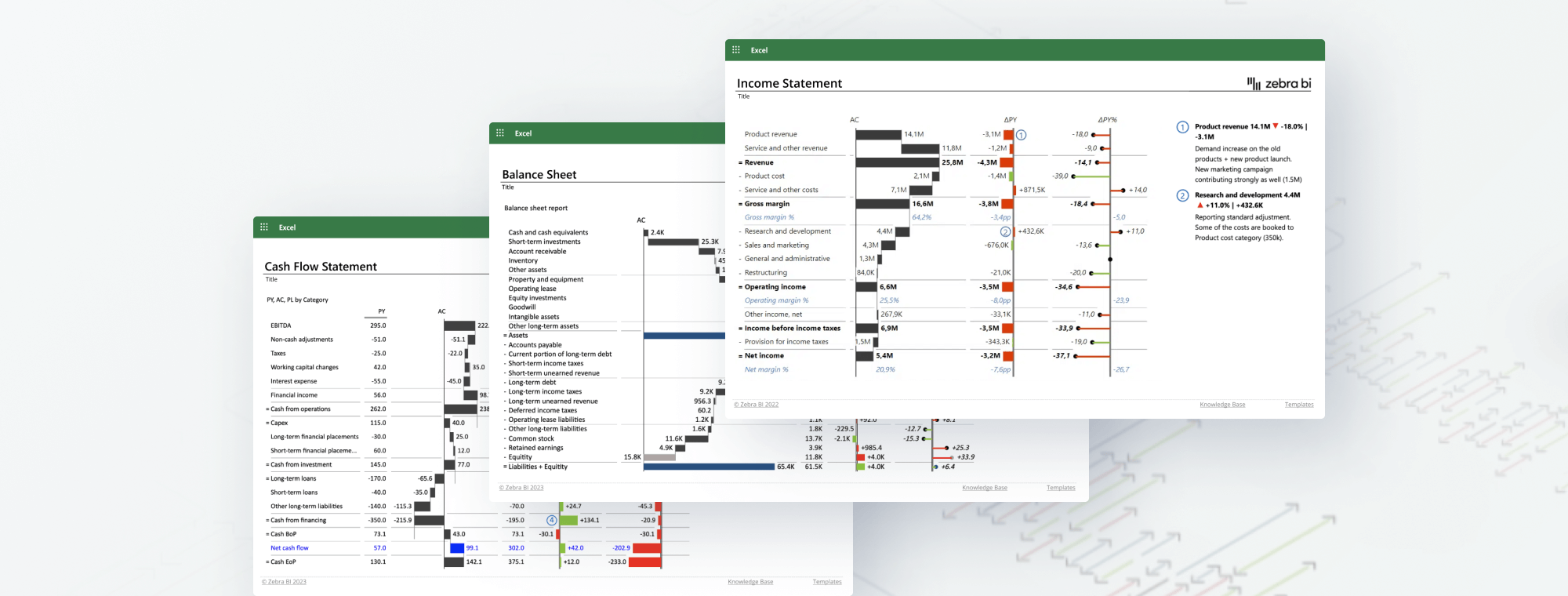

But there's also a quicker and easier way. Instead of doing it manually, you can try using Zebra BI, a great Excel Add-in that allows you to create advanced business charts in a couple of clicks.

The above cash flow statement data is presented in a type of analysis called contribution analysis. It is the optimal data visualization in cases where the whole (total) values (visualized as "fixed" columns or rows) are explained by partial (subcategory) values (usually visualized as red/green columns or rows). In our case, the whole value is cash position at a certain point in time, while the partial values are net income/outcome from different types of business activities (operating, investing, financing).

Now is your turn

Get your free Excel file and follow the guide along to create your first actionable cash flow statement.

Once you have Zebra BI downloaded, prepare your data as shown on the left, then insert the Contribution>Variance Column chart.

Note: You can learn more about creating waterfall charts with Zebra BI in our Support Center.

2. Preparing cash flow statement for past actual data

In general, you have two options/methods to prepare cash flow statements for past periods. Direct and indirect methods.

The direct method means that you summarize and classify each inflow and outflow from your company’s bank account. It gives you the best information on your cash activities. However, this method is not preferred and used by most companies since it requires much more effort to prepare.

This is why most companies prefer the indirect method of preparing cash flow statements. It means that you take your Profit and loss statement and your Balance sheet and calculate the Cash flow statement out of them. It is more convenient to prepare a Cash flow statement using the indirect method and besides that, this method gives you another point of view. It clearly shows a connection between reported net income (from the Profit and loss statement) and cash provided by operations (the most important category in the Cash flow statement).

3. Preparing cash flow forecast for future months

In our previous chart, we also presented a cash flow forecast to the right of cash flow for actual data. When it comes to cash flow forecast, we should distinguish between:

- short-term forecast (few weeks) and

- longer-term forecast (a few months up to half a year).

To prepare a short-term forecast you first need to have a list of receivables and payables with due dates and should know if and which of your customers tend to delay with their payments. Furthermore, you should also take into account all other potential activities that have a bigger impact on cash flow (such as investments, loans taken or repaid…). Based on all this information you can prepare an inflow and outflow forecast, but for no longer period than a few weeks.

Note: To increase reliability of your business and avoid liquidity issues, you should plan your cash flow for longer than 2-3 weeks. You should know today whether you will need additional financial resources in 4, 5 or 6 months so that you have enough time to arrange them.

Preparing a longer-term cash flow forecast is not a piece of cake :). The information we talked about earlier (receivables and payables with due dates…) does not give you a good basis to prepare the forecast for the next 6 months, because when you're dealing with such long periods, there are also other factors that influence your cash flow (for example season influence, growth…).

The SASH reporting team has developed advanced algorithms to calculate future cash flow based on your past actual data. Different types of cash flow projections are suitable for companies in different stages and in different industries and SASH reporting cash flow projections have all of them in mind. This kind of report gives you better insight and the ability to make better decisions regarding your planned cash-flow forecast.

We believe that many SMEs lack the know-how and resources to prepare and present such cash flow analysis but that doesn’t mean they don’t need it. SMEs need cash flow analysis as much as big companies do. In our opinion even more, because they can run into liquidity problems even faster. For example, SMEs that raised an investment should know their burn rate in order to know if and when they will have to provide additional financial resources. SASH reporting is the option of help for SMEs in need of cash flow or any other type of analysis.

Would you like to see your cash flow in a contribution chart?

Visit our website www.sash-reporting.com or send your e-mail with your needs to sasha@sash-reporting.com.

SASH reporting enables you to improve your processes, get a better insight into your business, and above all achieve greater results.

September 8th

September 8th February 22nd

February 22nd

Thanks for this amazing and intriguingblog, it addded vakue to my colleagues as I keep sharing your blogs. Loed the write up.

Alos, I write on a similar niche, could please take out some time to share your views on it here: Cash Flow Formulas