How to Calculate Compound Interest in Excel

Calculating compound interest in Excel can be daunting, especially if unfamiliar with the tool. However, with some knowledge and practice, you can easily calculate compound interest and get accurate results. In this article, we will guide you through calculating compound interest in Excel, including understanding the concept of compound interest, different types of compound interest, creating a table, using built-in functions, tips and tricks, and common errors to avoid.

Introduction to Compound Interest

Compound interest is a type of interest that is added to the principal amount, and then the interest is calculated on the new amount. It differs from simple interest, where only the principal amount is used to calculate the interest. Compound interest is commonly used in financial institutions like banks and investment companies.

One of the benefits of compound interest is that it allows for the exponential growth of investments over time. This means that even small amounts of money can grow significantly over a long period of time, making it a popular choice for retirement savings.

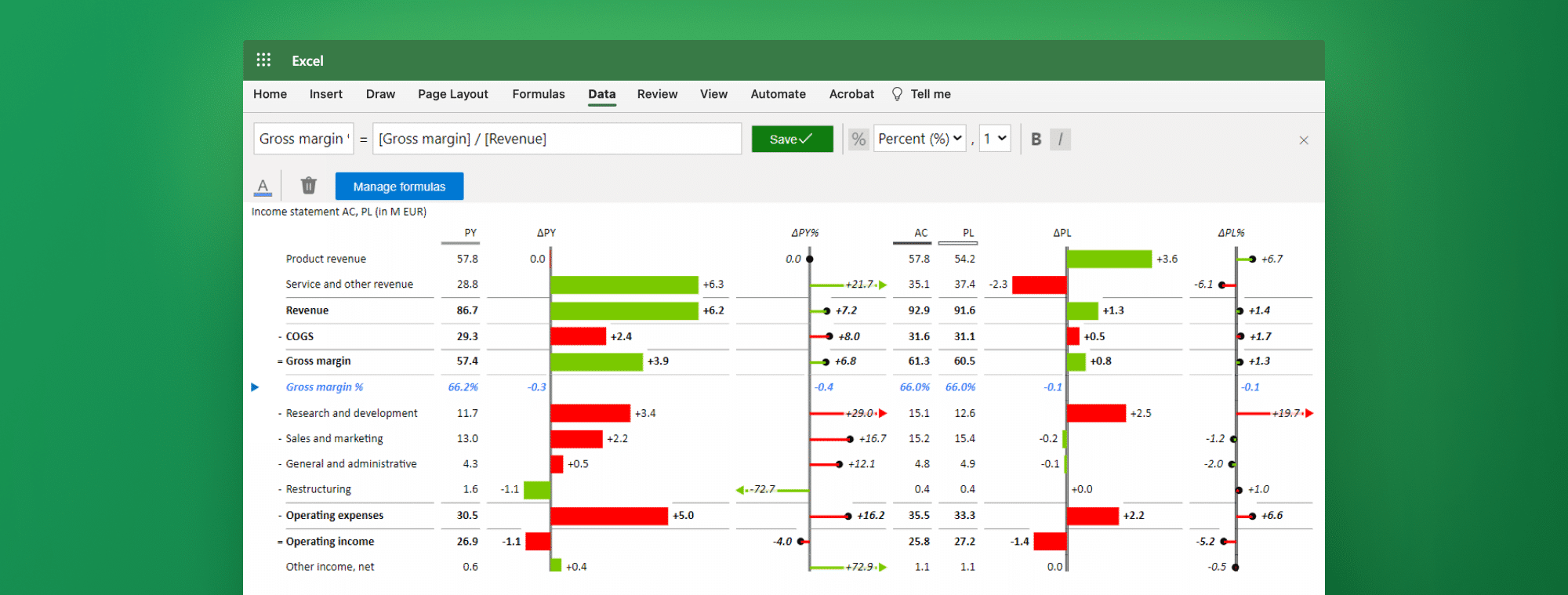

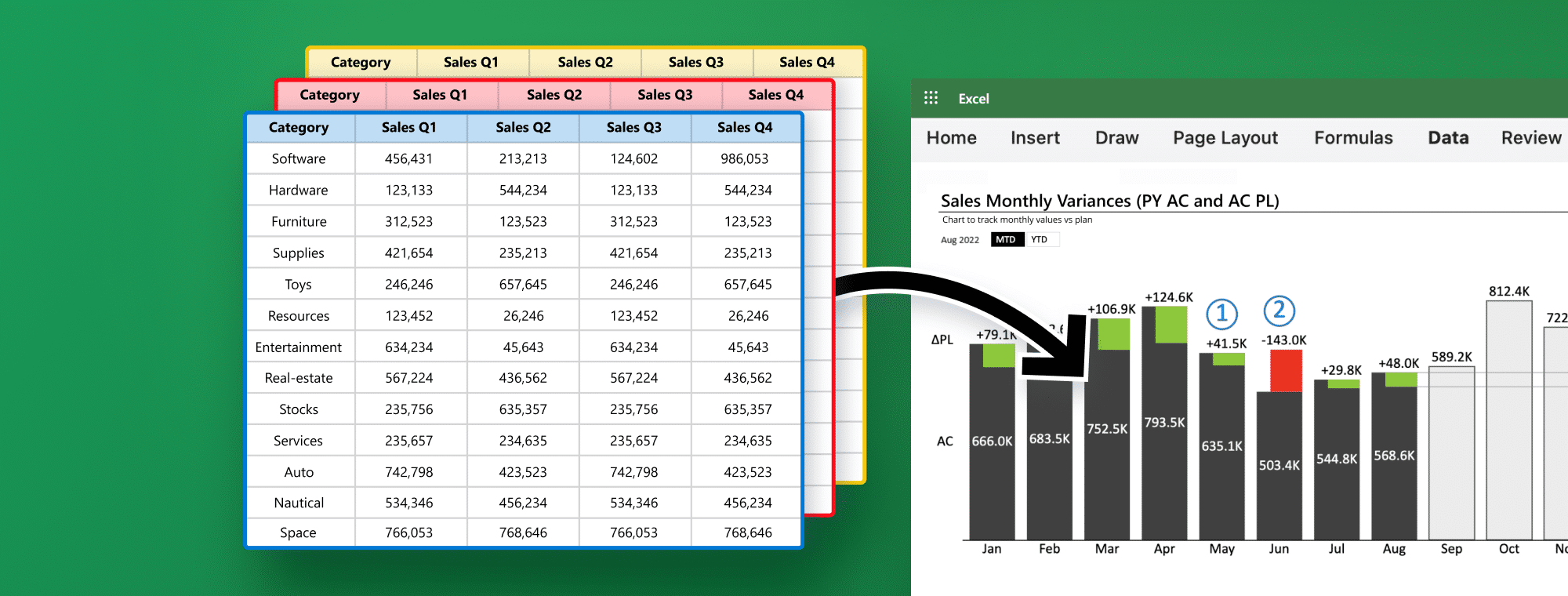

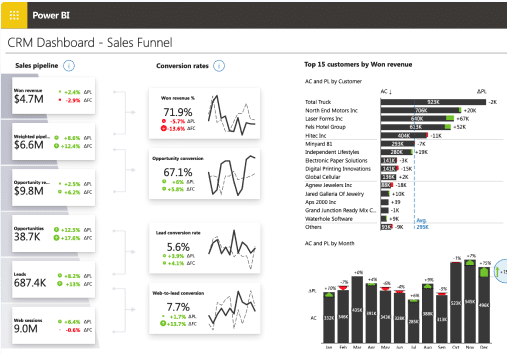

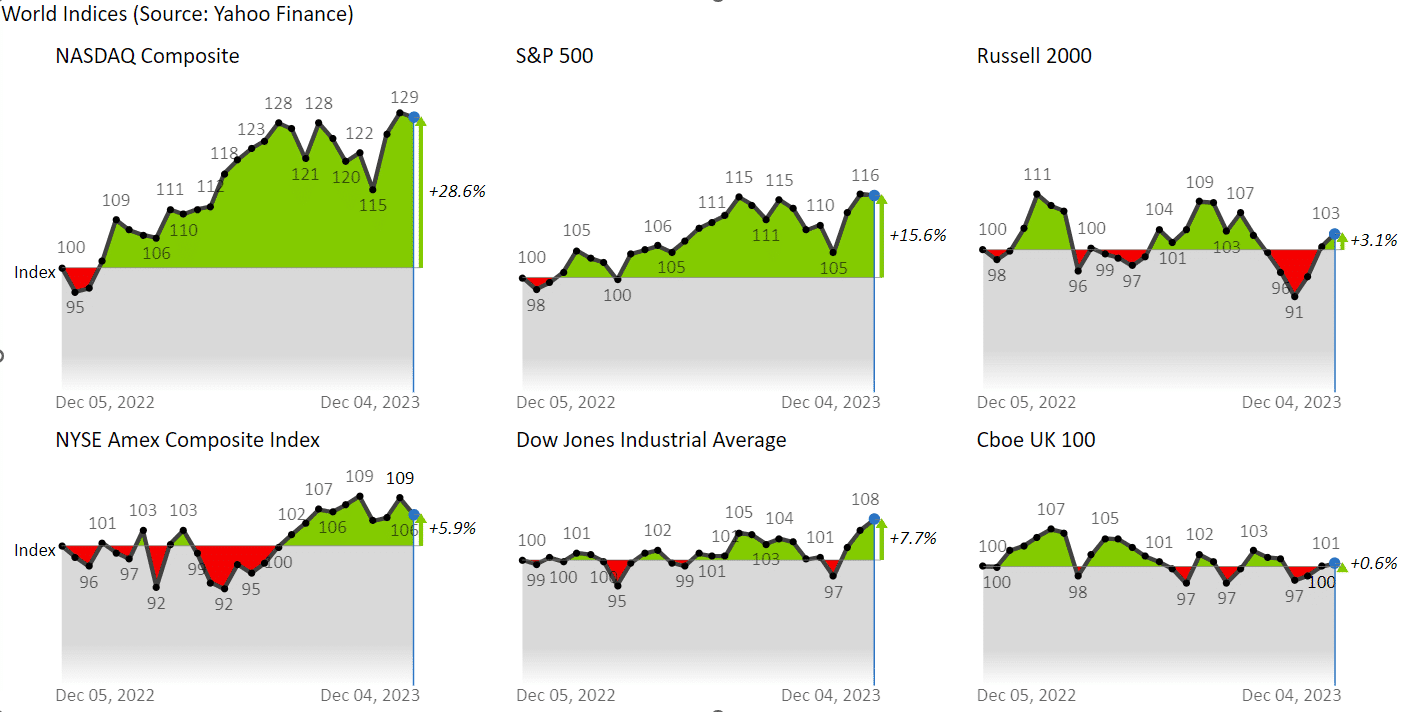

Compare your returns on your investments over a longer time period against world indices or any other financial instruments using Zebra BI Small multiples. Simply input values and the rest are handled by visuals (IBCS-compliant formatting, automatic scaling, and automatic variance calculation).

However, it is essential to note that compound interest can also work against you if you have debt. Credit cards and loans often use compound interest, meaning the longer you take to pay off the debt, the more interest you will accumulate. It is essential to be aware of the interest rates and payment schedules when taking on debt to avoid getting trapped in a cycle of compounding interest.

Understanding the Concept of Compound Interest

The concept of compound interest can be a little confusing. To understand it, let us take an example. Suppose you invest $1,000 in a bank that offers an interest rate of 10% per year. At the end of the first year, the bank will add 10% of your principal amount, $100, to your account. So, your new balance becomes $1,100. At the end of the second year, the bank will add 10% of your new balance, $110, to your account. So, your new balance becomes $1,210. This process will continue for as long as you keep the money in the bank.

It is important to note that compound interest can work for and against you. If you borrow money, compound interest can cause your debt to grow rapidly. On the other hand, if you are investing money, compound interest can help your savings grow significantly over time.

Another factor to consider when dealing with compound interest is compounding frequency. Some banks compound interest annually, while others compound it monthly or even daily. The more frequently interest is compounded, the faster your savings will grow, but it also means that you will earn less interest on your interest if you withdraw your money before the end of the compounding period.

Different Types of Compound Interest

There are different types of compound interest. The most common types are daily, monthly, quarterly, half-yearly, and yearly compounding. Daily compounding means the interest is calculated and added to the account daily. Monthly compounding means that the interest is calculated and added to the account every month, and so on. The interest rate and compounding period determine the final amount.

It is important to note that the frequency of compounding can significantly impact the total amount of interest earned. For example, if you invest $10,000 at an annual interest rate of 5%, with daily compounding, you would earn $512.32 in interest after one year. However, if the interest is compounded annually, you earn only $500 after one year. Therefore, it is crucial to consider the compounding frequency when choosing an investment option.

How to Use Excel for Calculating Compound Interest

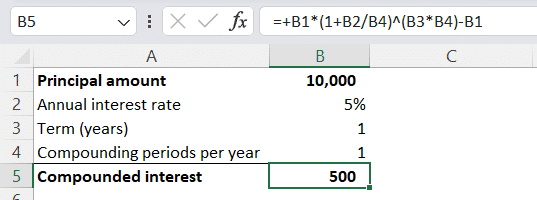

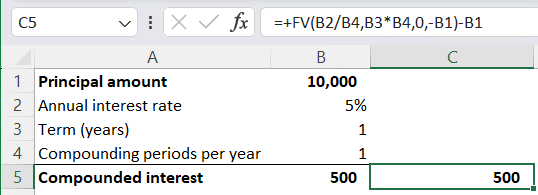

Excel is a powerful tool that can be used to calculate compound interest. The first step is to open Excel and create a new spreadsheet. In cell B1, enter the principal amount; in B2, enter the annual interest rate. Cell B3 should contain information about the term (years). In the fourth cell (B4), enter the compounding periods per year. It is important to note that the compounding period and term must be entered in the same time units. Once all the necessary information is entered, the formula for calculating compound interest can be added to cell B5. The formula is: =B1(1+B2/B4)^(B3*B4)-B1

Learning the Basic Excel Formulas for Calculating Compound Interest

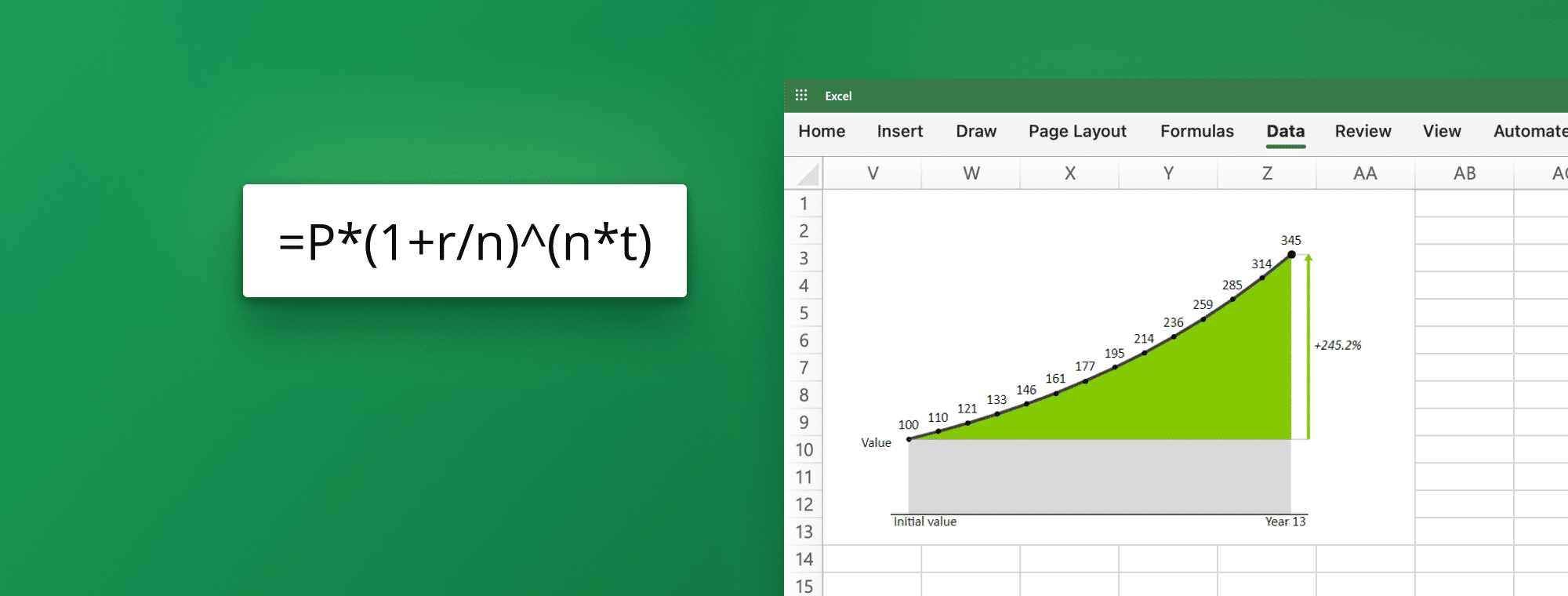

There are two basic formulas for calculating compound interest in Excel. The first formula is =P*(1+r/n)^(n*t), where P is the principal amount, r is the interest rate, n is the compounding period, and t is the term.

It is important to note that the compounding period and interest rate must be simultaneous. For example, if the interest rate is given as an annual rate, the compounding period must also be in years. Additionally, Excel has built-in functions for calculating the number of compounding periods and the interest rate per period, which can be helpful when working with more complex calculations.

Alternatively, you may choose to use the FV Excel function to calculate it. In that case, your calculation would look like this:

How to Calculate Simple Interest in Excel?

To calculate simple interest in Excel, use the formula =P*r*t, where P is the principal amount, r is the interest rate, and t is the term. This formula differs from the compound interest formula as it only uses the principal amount.

It is important to note that the interest rate should be entered as a decimal, not a percentage. For example, an interest rate of 5% should be entered as 0.05 in the formula. Additionally, the term should be entered in the same units as the interest rate. For instance, if the interest rate is annual, the term should also be in years.

Simple interest is commonly used in loans, such as personal loans or car loans. It is also used in some types of investments, such as bonds. Using Excel to calculate simple interest, you can easily compare different loan or investment options and make informed financial decisions.

To make your analysis more understandable and easier to notice the differences between financial instruments, visualize your results with Zebra BI Charts and Tables.

Creating a Table for Calculating Compound Interest in Excel

To create a table for calculating compound interest in Excel, follow these steps. First, enter the principal amount, interest rate, compounding period, and term in separate cells. Then, create a formula in the next cell using either of the earlier ones. Drag the formula down to calculate the compound interest for different terms.

It is important to note that the compounding period and interest rate must be simultaneous. For example, if the interest rate is annual, the compounding period must also be in years. The compounding period must also be months if the interest rate is monthly. Failure to do so will result in inaccurate calculations.

Additionally, Excel has a built-in function for calculating compound interest, which can be accessed by typing "=FV()" in a cell. This function allows you to input the principal amount, interest rate, compounding period, and term all in one formula, making it easier and quicker to calculate compound interest.

Understanding the Factors That Affect Compound Interest Calculation

Several factors affect the compound interest calculation, such as the principal amount, interest rate, compounding period, and term. Higher principal amounts, interest rates, and more frequent compounding periods result in higher compound interest. The term also affects the final amount, as the longer the term, the higher the compound interest.

It is important to note that compound interest can work for and against you. Compounding interest can help your money grow significantly when saving or investing. However, when borrowing money, compound interest can cause your debt to grow rapidly if you do not make regular payments. It is essential to understand the impact of compound interest on your finances and make informed decisions accordingly.

Using Built-In Functions in Excel for Calculating Compound Interest

Excel has several built-in functions to help calculate compound interest or elements that affect it. FV, PV, RATE, and NPER are the most commonly used functions. FV stands for future value, PV stands for present value, RATE stands for interest rate, and NPER stands for the number of periods. These functions can calculate the compound interest, present value, interest rate, or term.

One important thing to note is that these functions can be used not only for calculating compound interest on loans or investments but also for other financial calculations, such as annuities, mortgages, and bonds. For example, the FV function can be used to calculate the future value of an annuity, while the PV function can be used to calculate the present value of a bond.

Tips and Tricks for Accurate Calculation of Compound Interest in Excel

Here are some tips and tricks for accurately calculating compound interest in Excel. Always double-check your formula to avoid errors. Make sure to use the correct interest rate and compounding period. Be consistent with your units of time, such as years or months. Use the dollar sign to fix the reference cell so the formula does not change when copied to other cells. Lastly, use the IFERROR function to catch any errors in your formula.

Common Errors to Avoid When Calculating Compound Interest in Excel

Some common errors to avoid when calculating compound interest in Excel are using the wrong formula, the wrong interest rate, the wrong compounding period, and the wrong units of time. Another error is forgetting to fix the reference cell with the dollar sign.

Real-Life Applications of Using Excel for Calculating Compound Interest

The application of Excel for calculating compound interest is not limited to financial institutions. It can also be used for personal finance, such as calculating loan repayment amounts or retirement savings. Excel can also be used for business planning, such as calculating investment returns or growth projections.

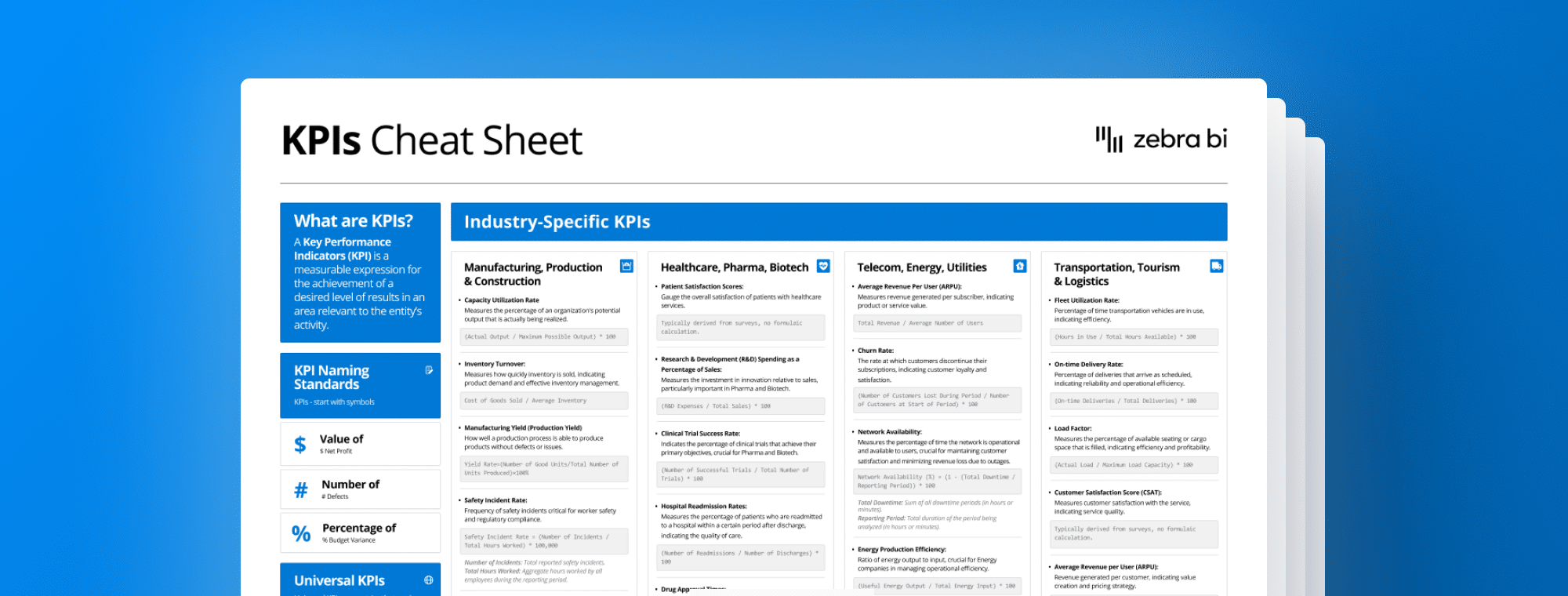

For the purpose of presenting the business plans, make sure you communicate them in a clear and concise manner. In a way that everyone immediately understands where the future growth is coming from. To do that, you must equip your presentation with variances, comments, and standardized formatting. In the best-case scenario, you would check out IBCS standards and ensure you follow the best business communication practices. Luckily, Zebra BI Charts and Tables are here to cover all of that with a few clicks.

Conclusion: Mastering the Art of Calculating Compound Interest in Excel

Calculating compound interest in Excel may seem complex at first, but with practice, anyone can master it. By understanding the concept of compound interest, using the correct formulas, creating tables, using functions, avoiding common errors, and applying it to real-life situations, you can become proficient in Excel and Excel for finance and make informed financial decisions.

September 8th

September 8th February 22nd

February 22nd