How to use Excel for financial statement analysis: 8 brilliantly simple tips

In today's fast-paced business environment, you need a tool like Microsoft Excel to analyze financial data quickly and accurately. In this guide, we'll explore how to effectively use Excel for financial statement analysis. Read on to learn just how this can help you make better decisions and drive success in your organization.

We'll cover the benefits of using Excel for financial statement analysis, the steps to prepare and present your analysis, and why Zebra BI for Office is the ultimate tool to help you take it to the next level.

Although some have reservations about using Excel for a financial statement analysis, it's actually a super powerful tool.

Why prepare financial statement analysis in Excel?

The truth is, Excel is packed with numerous advantages that make it the go-to tool for finance professionals around the globe. Let's have a look at a few reasons why it's a powerful ally when it comes to financial statement analyses:

- Automation: Excel can help you streamline your financial analysis process. Once you've entered the relevant formulas for calculations such as financial ratios, KPIs, and trend analysis, Excel will automatically update these values as you input new data. This one-time formula entry saves time and effort, allowing you to focus on making data-driven decisions.

- Accuracy: Excel's precise calculations ensure accuracy and consistency across your financial analysis. With reliable results, you can be confident in your conclusions and present stakeholders with credible reports.

- Flexibility: Need to adjust your calculations or presentation style? Excel enables you to customize your analysis easily, making it simple to adapt to changing business needs or new insights.

- Data Management: Excel is excellent for managing and organizing large volumes of financial data. This capability allows you to draw meaningful conclusions while providing a high-level overview and the option to dive deeper into the details.

- Collaboration: Excel facilitates seamless collaboration by allowing you to share your financial statement analysis with colleagues. Multiple users can work on the same document, streamlining the reporting process.

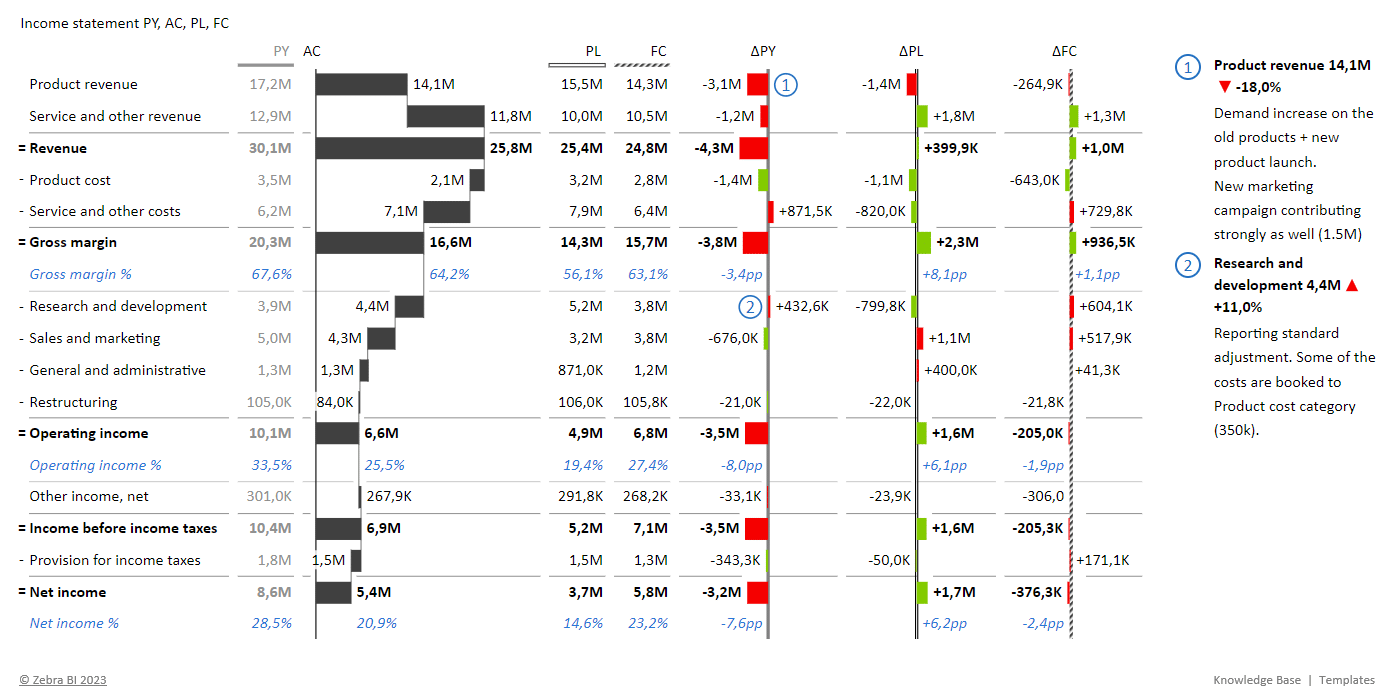

- Visualization: By visualizing your financial statement analysis in Excel, you can make it much clearer and more efficient. While Excel does offer some visualization options, they are pretty limited. A powerful add-in like Zebra BI for Office can help you streamline the process & uncover actionable insights in seconds. This way, you can quickly identify critical information such as variances against the previous year or plan.

Now that we've established why it's crucial to use Excel for financial statement analysis, let's dive into how to prepare and present your analysis effectively.

How to prepare financial statement analysis and present results in Excel

To effectively use Excel for financial statement analysis, you need to follow a systematic approach. But don't worry, it's easier than it sounds. Here's how you can go about it:

1. Gather financial information

Begin by collecting all the relevant financial data. The key here is granularity – you want detailed data that allows you to dig into specific areas of your financial statements. This could be data broken down by product line, business unit, region, or any other segment relevant to your organization. The more detailed your data, the more insights you can uncover.

2. Organize data and analyze your financial statements

Organization is crucial when dealing with financial data. Excel allows you to separate your raw input data from your analysis calculations which you should absolutely do. This way, you can maintain clean, easy-to-read financial reports that inspire confidence in their credibility. Remember, a messy report can lead to confusion, errors, and ultimately, a loss of credibility.

3. Allow traceability by using linking formulas

Make sure every calculation can be traced back to its source data. This makes it easier for others to understand your work and for you to spot any potential errors. It also promotes transparency, accuracy and credibility in your financial analysis.

4. Calculate key financial ratios & compare them to targets and industry benchmarks

Excel excels (pun intended) at computations. It allows you to easily calculate key financial ratios such as gross profit margin, EBITDA margin, and debt-to-equity ratio. These provide invaluable insights into your company's financial health. Comparing them to your internal targets and industry benchmarks can help you gauge your performance and identify areas for improvement.

- Income statement: gross profit margin, EBITDA margin, operating profit margin, earnings per share, operating expenses as % of sales

- Balance sheet: current ratio, quick ratio, debt-to-equity ratio, debt-to-assets ratio, Net debt-to-EBITDA

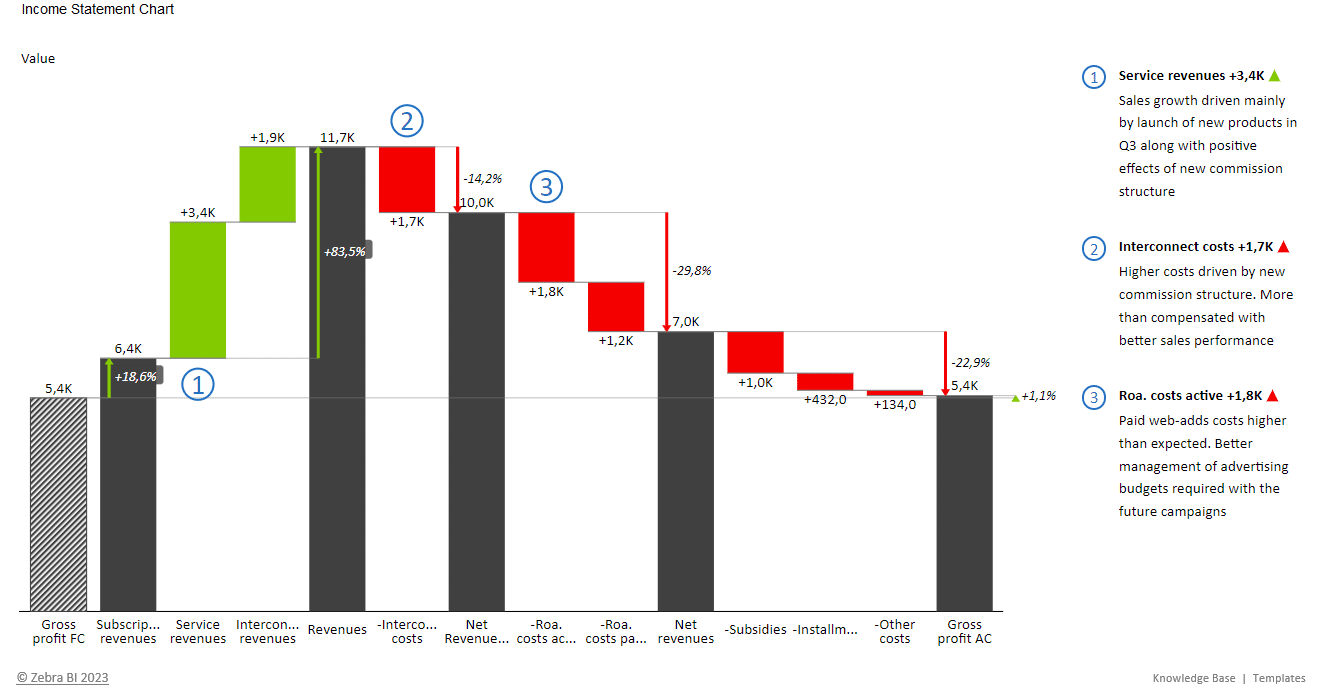

5. Spot the main drivers of variances against the previous year and plan

Identifying variances is crucial in financial analysis. Once you do, you can dig deeper into the general ledger/trial balance to find explanations for these variances. This enables you to address any issues promptly.

6. Have supporting sheets ready for a fully data-driven storytelling approach

Supporting sheets can include breakdowns of sales, costs, and any other relevant financial data, enhancing your financial story with context and details. This will help you create a compelling narrative around your performance.

7. Use Pivot Tables to facilitate data grouping and insight discovery

Pivot Tables are like the Swiss Army knife of Excel, featuring all sorts of different tools that you can use to make sense of your data. You can use them to summarize and analyze large datasets, which makes it easier for you to draw actionable insights. By grouping your data in different ways, you can also use them to uncover patterns and trends that might be less obvious in a standard table format.

8. Visualize financial statements

A well-designed, professional-looking report can enhance your credibility and make your conclusions more persuasive. By delivering meaningful insights in a way that is clear and easy-to-understand, it makes it easier for the decision-makers to take the right steps faster. Here are some tips to help you with this:

- Display financial statements in a table with financial periods (previous year, actuals, forecast, and plan) in adjacent columns to identify trends and variances easily

- Clearly denote units in your analysis and presentation to avoid incorrect conclusions

- Incorporate comments into your report to answer questions upfront and guide your readers through it

These steps will help you use Excel for financial statement analysis effectively, allowing you to maximize the insights you gain from your data.

Zebra BI: The Ultimate Tool for Visualizing Your Financial Statement Analysis in Excel

Excel is powerful, but Zebra BI for Office takes your financial statement analysis to the next level. By integrating seamlessly with Excel, it enhances your analysis and helps you make smarter, more informed decisions.

It streamlines data visualization, allowing you to create stunning and insightful reports fast and with zero effort. The best part? It's IBCS-compliant out of the box! With its easy-to-use interface and customization options, it enables you to quickly adapt your analyses to suit your company's needs.

The tool also offers advanced data management capabilities, empowering you to handle large data sets with ease. Oh, and have we mentioned top-notch collaboration features available for PRO plans? They enable your team to work on your reports and dashboards together, saving you time, maintaining consistency & boosting your productivity.

Why settle for good when you can have the best?

Get Zebra BI for Excel today and unlock the full potential of Excel for financial statement analysis. Unsure if that's what you're looking for? Try out Zebra BI for Office for free. It comes with a free instructional file that will help you get started.

September 8th

September 8th February 22nd

February 22nd

Great.