9 Common Mistakes of an FP&A Analyst – And How to Avoid Them

As we journey through the labyrinth of financial planning & analysis, it's crucial to pause, reflect, and sometimes laugh at the stumbles and pitfalls that befall even the best of us. Whether you're an aspiring junior, a seasoned FP&A analyst, or a recruiter scouting for your next star performer, this compendium of faux pas and their remedies will help you dodge the bullets that once grazed us.

Let's peek into the treasure chest. We'll explore how data accuracy can make or break your credibility and why interdepartmental communication is more critical than you think. You'll learn about the art of presenting information effectively, the challenges of time management, and the importance of not losing sight of the bigger picture. We'll dissect the limitations of relying too much on historical data, the importance of questioning assumptions, the power of leveraging technology, and lastly, the benefits of staying updated with the right tools.

Want to Skip the Advice & Immediately Explore Your Next Favorite FP&A Tool?

Zebra BI offers a seamless and intuitive experience that makes visualizing your FP&A analysis a breeze. Equip yourself with Zebra BI and get a head start in avoiding these common mistakes today. Try it out for FREE & embrace the journey towards FP&A excellence.

There's no definitive order to these missteps, just like there's no single path to success. But as you scroll through, remember: the goal isn't perfection, but continuous learning and improvement. And with that in mind, let's set the stage to unveil the 9 infamous misadventures in the life of an FP&A analyst.

Mistake #1: Treating Data Accuracy as an Afterthought

Imagine stepping on the stage with confidence, ready to deliver a rousing symphony, only to hit a glaringly false note. That's akin to an FP&A analyst underestimating the importance of data accuracy. Yes, it's an easy slip to make, especially when you're knee-deep in numbers and pressed for time. But beware, it's a misstep that can cost you your credibility.

Data is the lifeline of FP&A. It forms the basis for strategic decisions and informs business trajectories. An error, as tiny as it might be, can lead to wrong conclusions, flawed strategies, and quite frankly, red faces in the boardroom. In the role of an FP&A analyst, it’s not just about crunching numbers, but ensuring those numbers are accurate, reliable, and trustworthy.

Don't be shy about double-checking your data, implementing rigorous internal checks, and reconciling information within reports and dashboards. Especially when you're juggling data from different sources, maintaining a rigorous approach to data validation becomes paramount. Because at the end of the day, an FP&A analyst is only as good as their data. So, treat your data with the respect it deserves, and it will return the favor by bolstering your credibility.

Mistake #2: Overlooking Interdepartmental Communication

In the high-paced world of financial planning and analysis, it's easy for an FP&A analyst to adopt a tunnel vision approach, neglecting to communicate with other departments. But imagine trying to complete a puzzle with missing pieces. The picture just won't make sense, will it? That's the equivalent of crafting a business strategy without incorporating insights from different departments.

Effective communication isn't merely a courtesy, it's a necessity. By regularly connecting with various teams - be it sales, marketing, or operations - you gather essential feedback and input that fuel actionable and insightful reports. These are not just numbers, but stories of successes, failures, challenges, and opportunities, experienced by those on the frontlines of business.

The flip side? Failing to reach out can result in incomplete analyses, missed opportunities, and strategies that don't resonate with the realities of the business. So, step out of the financial echo chamber. Seek clarity, question assumptions, and gather as much information as possible. Because an FP&A analyst who truly understands the company dynamics is a powerful ally in steering the business towards success.

Mistake #3: Obscuring the Story with Cluttered Data

Einstein famously said, "If you can't explain it simply, you don't understand it well enough." This certainly rings true for the FP&A analyst role. One common blunder in the financial realm is not presenting information in a clear and concise manner. This might seem like a minor oversight, but it's akin to cooking a gourmet meal and serving it in a haphazard pile. The ingredients might be top-notch, but the presentation leaves much to be desired.

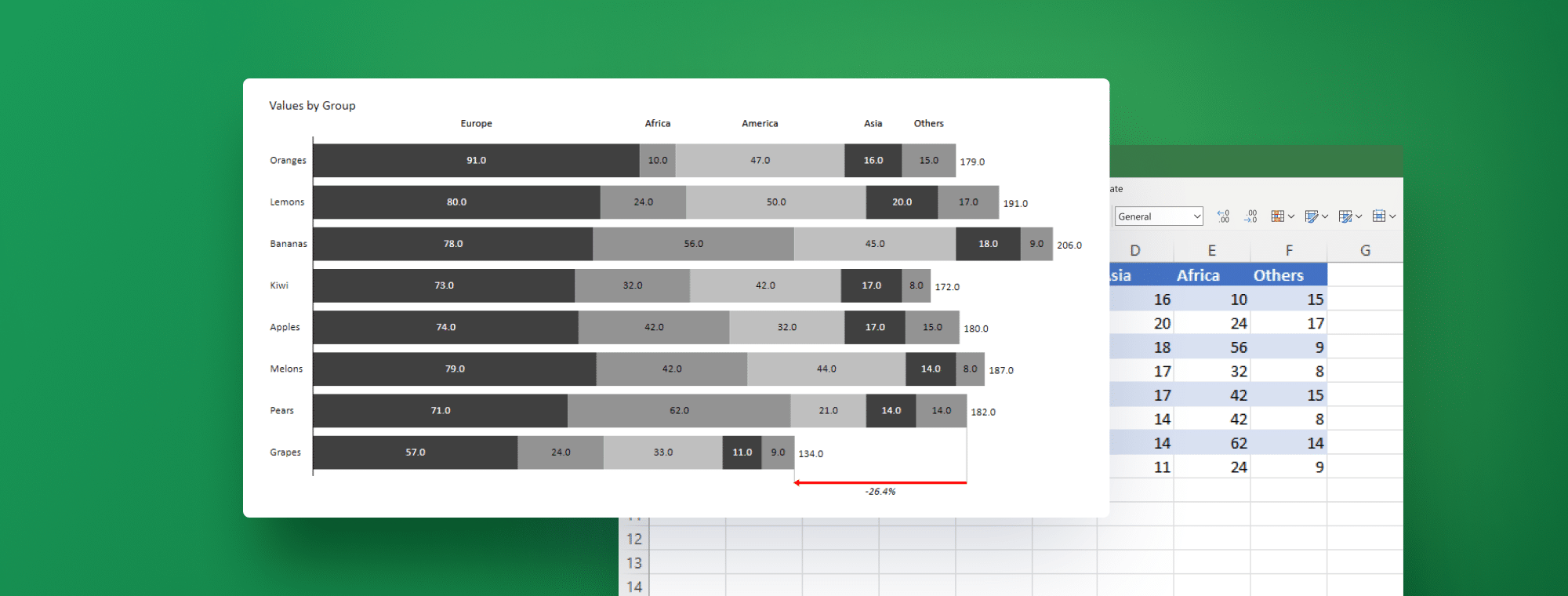

Crystal clear communication is essential in the FP&A world. This includes actionable reporting, standardization, and consistency. Adhering to International Business Communication Standards (IBCS) not only elevates your communication style but also ensures that your findings are easily understandable and actionable.

Remember, your audience may not have the time or inclination to decipher complex charts or sift through verbose reports. Therefore, Zebra BI visuals are your best bet for ensuring clarity and conciseness in your reports. With out-of-the-box IBCS standards and integrated comments feature, Zebra BI visuals turn your reports into clear, compelling narratives that drive effective decision-making, not just in Power BI but also Excel and PowerPoint.

Failing to prioritize clarity and conciseness can result in confusion, misinterpretation, and lost opportunities. So, as an FP&A analyst, strive to turn your data into compelling stories that inspire action.

Mistake #4: Playing Whack-a-Mole with Your To-Do List

If you've ever played Whack-a-Mole, you know that it's all about frantically hitting one mole after another as they pop up from their holes. But if you're managing your tasks as an FP&A analyst in a similar fashion - reacting to whatever pops up next - you're setting yourself up for an unproductive chaos. Failing to prioritize tasks and manage time efficiently is a pitfall even experienced professionals tumble into.

Juggling multiple tasks, meeting deadlines, and managing expectations are all in a day's work for an FP&A analyst. Without effective time management, you could find yourself drowning in a sea of spreadsheets, missing deadlines, or even worse, delivering subpar analyses.

It's not just about getting things done; it's about adding value to what you're doing by optimizing the processes. Being proactive, rather than reactive, can help you carve out a significant role for yourself within the organization. By delivering value-adding insight that provokes actions and supports quality decision-making, you demonstrate your indispensability.

But how can you get there? Start by prioritizing your tasks, focusing on the most critical ones first. Understand what tasks have the most impact on the business, and tackle those head-on. Consider tools that can ease your workload, like Zebra BI visuals, which let you create comprehensive and clear visualizations like waterfall charts in just a few clicks.

In summary, remember this - the key to being an effective FP&A analyst is not just about getting things done, but getting the right things done at the right time and in the right way.

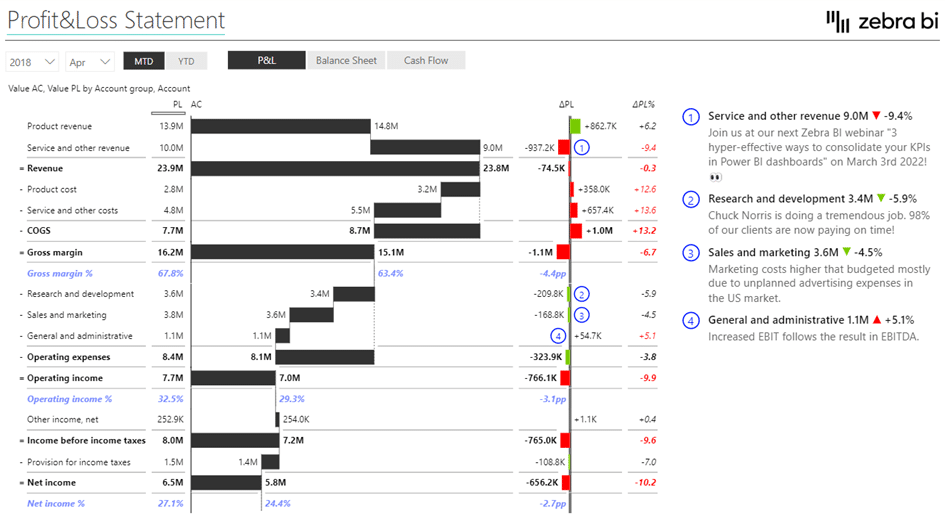

Mistake #5: Losing Sight of the Bigger Picture

As an FP&A analyst, it's easy to get lost in the minute details of data and numbers. But what happens when you're so focused on individual trees that you forget you're in a forest? You miss the bigger picture, and with it, the context and strategic insights that inform sound decision-making.

Understanding the organization's goals and broader context is crucial. Your dashboards and reports should answer pivotal questions like - Is our performance good or bad? By how much? Why? And, what actions should be taken next? The answers should be aligned with the company’s strategy, and should give a comprehensive view of the performance against the plans and strategies.

Neglecting the bigger picture can lead to misaligned strategies and missed opportunities. It's like trying to navigate through a city with a magnifying glass - you'll miss the major landmarks and possibly end up going in circles.

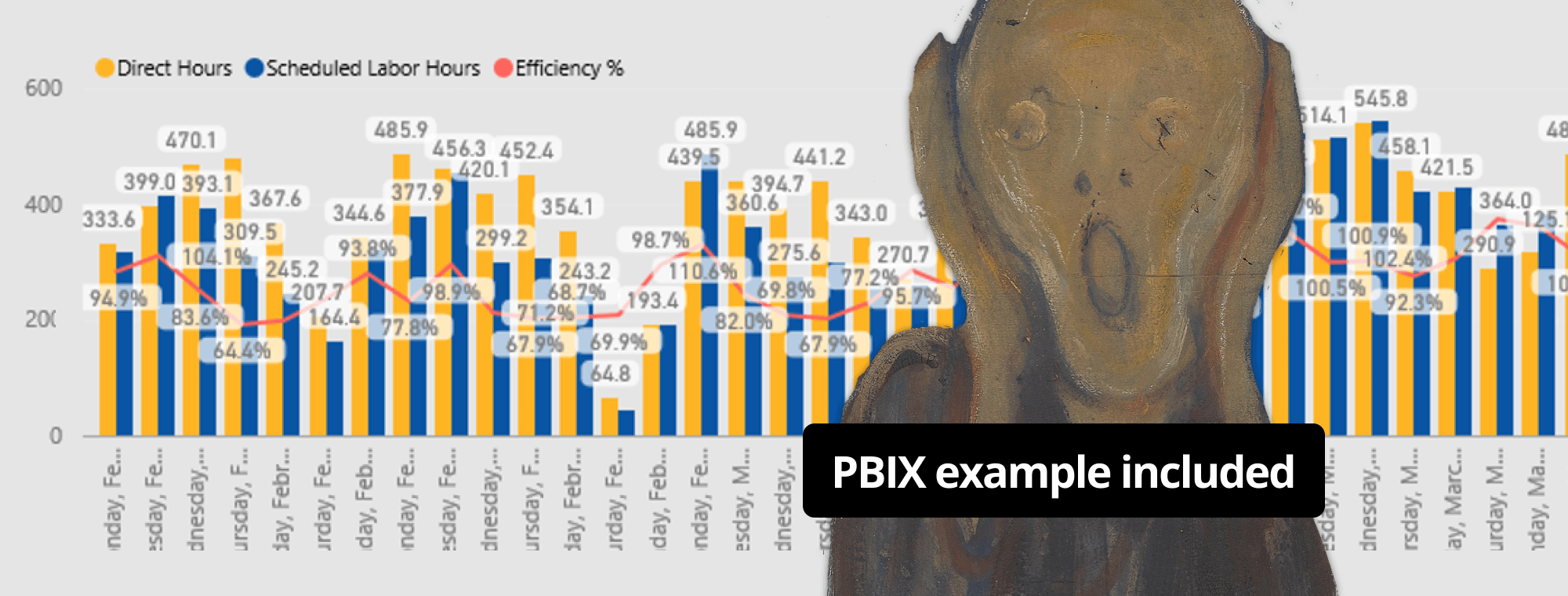

So, how do you avoid this pitfall? Start by considering the broader context in your performance or financial reports. Tools like Zebra BI visuals can be a great help here, since they automatically calculate variances to your benchmark data for you. This feature provides a comprehensive view of your performance, helping you align your analyses and strategies with the bigger picture.

Example of a Sales Dashboard created with Zebra BI for Power BI that delivers a comprehensive view of sales performance

In essence, remember this - as an FP&A analyst, you're not just dealing with data and numbers, you're dealing with the narrative of your organization. So, always keep the bigger picture in sight.

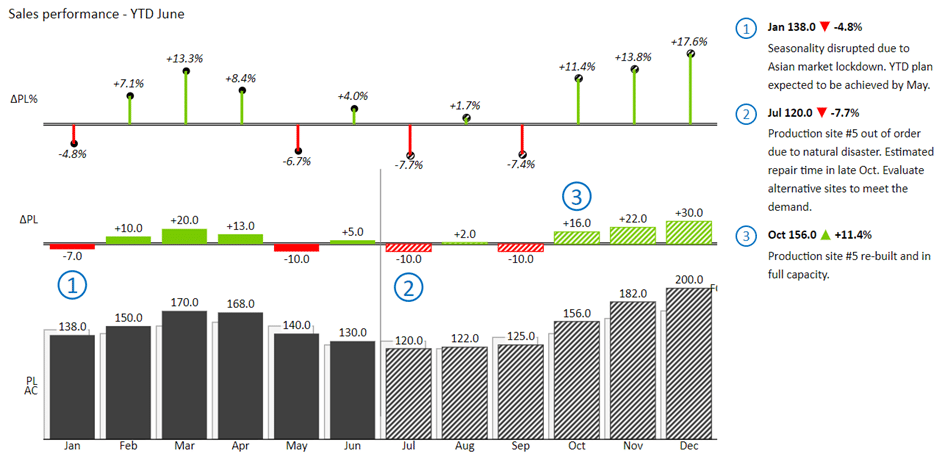

Mistake #6: Steering the Future with the Rearview Mirror

As an FP&A analyst, it's tempting to heavily rely on historical data for insights and projections. After all, it's tangible, readily available, and provides a solid base for understanding trends. But consider this - if you're driving a car, would you only look in the rearview mirror to navigate? You'd surely miss what's ahead, leading to potential accidents. The same principle applies in the realm of financial planning and analysis.

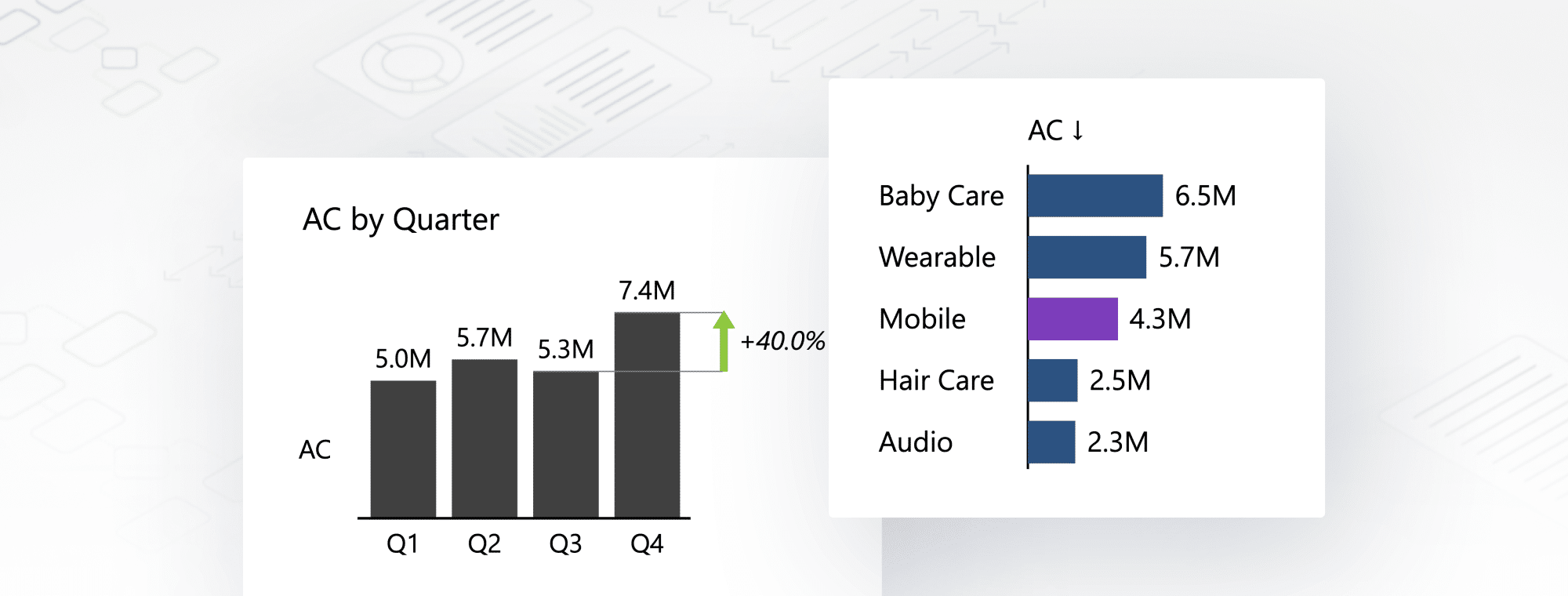

While historical data is a crucial part of your analysis, it's not the be-all and end-all. Your business performance analysis and reports should incorporate a balance of historical data (previous year data), actuals (AC), and projections (future plans). This balanced view allows you to be ahead of the game, prepare year-end forecasts, and compare your actuals and forecast for the remaining period against previous performance and future plans.

The question should not only be "where were we?" but also "where are we, and where are we going?" Over-reliance on historical data can lead to complacency, missed opportunities, and inability to adapt to changes and developments in the business landscape.

Zebra BI visuals can be an excellent tool in this regard, providing a comprehensive picture that brings together historical data, actuals, and future projections. With these visuals, you're not just building charts, but creating a dynamic narrative of past, present, and future business performance.

In conclusion, while the past can inform the present, don't let it limit the future. As an FP&A analyst, your role is to navigate the business through the currents of change and towards the shores of success.

Mistake #7: Taking Assumptions at Face Value

In the world of FP&A, there's one golden rule you should never forget: Question everything. An FP&A analyst who doesn't challenge assumptions is like a detective who takes every alibi at face value - it's a quick path to misconstrued facts and misleading conclusions.

Challenging assumptions and employing critical thinking are key to delivering accurate and insightful analyses. It's about questioning the given, probing deeper, and anticipating the questions your report viewers might ask. Consider this: When you're looking at a report, what would you want to know? What insights would be helpful to you?

By putting yourself in the shoes of report viewers and preemptively incorporating answers throughout the report, you're not just sharing data, but creating a robust, valuable narrative. It's like the difference between telling a story with unexpected twists and turns versus just listing the events chronologically.

Remember, your goal as an FP&A analyst is not just to accept information as is, but to dig deeper, challenge the status quo, and provide insights that drive strategic decisions. This is what sets exceptional analysts apart - the ability to question, to probe, and to uncover the truths hidden beneath the surface.

Mistake #8: Leaving Tech Tools on the Bench

In the fast-paced arena of FP&A, technology is not just a luxury; it's a necessity. Yet, some analysts hold back, failing to fully harness the power of technology. It's like having a state-of-the-art toolbox but only using a single wrench.

The benefits of leveraging technology in FP&A analysis are immense. From automating time-consuming processes to making data analysis more efficient, technology can be a game-changer. It enhances decision-making by providing you with accurate, timely information, transforming raw data into valuable insights.

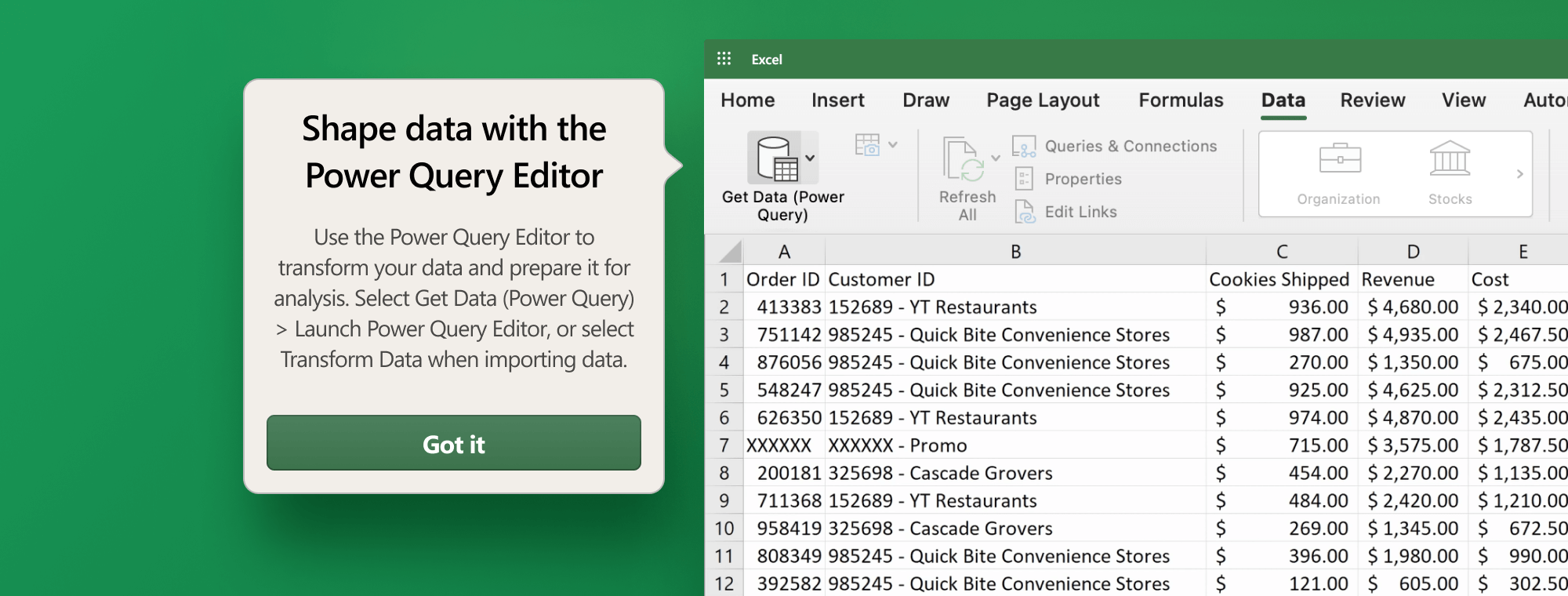

The first step in leveraging technology is embarking on a digital transformation journey. This isn't merely about adopting new tools, but also about shifting your mindset. It's about recognizing the potential that technology brings to the table and being willing to explore it.

Zebra BI is a prime example of the tools that can revolutionize your FP&A operations. It offers a seamless cross-platform experience between Power BI, Excel, and PowerPoint, with visuals that are intuitive, interactive and easy to master. The similar interaction design across the platforms means you're not learning three different systems - you learn one and apply it across the board.

So, don't let your tech tools collect dust. Harness the full potential of technology, and let it elevate your FP&A analysis to new heights.

Mistake #9: Overlooking the Knowledge Goldmines

In today's data-driven world, staying updated is not just beneficial; it's vital for your growth as an FP&A analyst. Yet, some analysts fall into the trap of complacency, neglecting the wealth of knowledge available to them. It's akin to having a library at your disposal but choosing not to read any books.

Zebra BI channels serve as an invaluable repository of FP&A tools, insights, and latest trends. Whether it's a deep-dive tutorial on YouTube, a thought-provoking post on Facebook, LinkedIn or Twitter, an informative webinar, a handy template, or an insightful article on the Zebra BI blog, there's always something to learn.

Not following such channels regularly is a missed opportunity. It's like having a masterclass at your fingertips and choosing not to participate. By staying updated, you not only enhance your skills but also stay ahead of the curve in the ever-evolving FP&A landscape.

So, don't make the mistake of ignoring this treasure trove of insights. Make it a habit to regularly check Zebra BI channels. Learn, grow, and master the tools and topics that are essential for every FP&A analyst. Because staying updated is not just about knowing the latest trends, it's about continuously striving for excellence in your field.

Get Started with Zebra BI - Your Key to Mastering FP&A

Don't just learn about the common mistakes made by FP&A analysts; take the next step. Streamline your workflow and create next-level actionable reports that impress with Zebra BI.

September 8th

September 8th February 22nd

February 22nd