Adjusted Financial Statements & Adjusted EBITDA: How to Unlock Their True Power in Excel

Welcome to the high-stakes game of financial adjustments! Strap in, as we are about to embark on an exciting journey, delving deep into the world of adjusted financial statements and learning to tame the mighty beast known as adjusted EBITDA.

Let's face it, the term "adjusted financial statements" may not send a ripple of excitement through the room, but in the vast financial seascape, these adjustments are the unsung heroes, working behind the scenes. They polish and perfect your data, aligning it with international standards and smoothing out inconsistencies. Their magic transforms your numbers into a masterpiece, primed for comparison with your competitors in the grand financial art gallery.

This guide will lead you through some twists and turns of creating adjusted financial statements and finding your way around adjusted EBITDA. So get ready for some awe-inspiring financial acrobatics, brought to you in Zebra BI style! It's time to turn those numbers into a harmonious symphony that tells your business's unique financial story. Let's get this show on the road!

Present Your Financial Adjustments with Zebra BI for Excel

Reveal hidden insights, amaze stakeholders, and streamline your financial reporting process FREE of charge. Try it out now.

Why and when to adjust financial statements?

Imagine you're painting a picture, but the colors keep changing. It would be pretty hard to create your masterpiece, right? The same goes for financial data. With the ebb and flow of business, changes are bound to happen, and these fluctuations need to be accounted for. This is where the magic of adjusted financial statements comes into play.

So why adjust financial statements? Well, there are a few key reasons:

- Comparison/Benchmarking: When you adjust revenues, gross profit, EBITDA, operating profit, net income, working capital, net debt, equity, and so on, you're basically giving your data a uniform attire. This makes it much easier to line your figures up next to your competitors' and see who’s wearing it best.

- Consistency and Comparability: Adjusting your financial statements helps maintain consistency over time and enables comparability across different periods. Think of it like a translator, helping everyone speak the same financial language.

- Accuracy and Conformance: The financial world has its own set of rules and standards, and adjusted financial statements ensure your data fits into this framework. It's a bit like dotting your i's and crossing your t's - it makes sure everything's as it should be.

And when should you perform these adjustments? The end of accounting periods – be it monthly, quarterly, or annually - is the perfect time to roll up your sleeves and dive into the adjustment process. Like a regular check-up for your finances, it ensures your financial health is up to par, ready to face the next period head-on.

In short, adjusted financial statements are like a pair of glasses for your financial data, providing a clearer, more accurate view of your business's fiscal landscape. So, grab that lens cleaner and let's get ready to see your financial world in high-definition!

What are some common adjustments to financial statements and/or EBITDA?

Ready to pull back the curtain on your financial statements? Let's embark on a journey into the core of common adjustments. These adjustments aren't just number-crunching exercises, they're a pivotal part of crafting an accurate and insightful financial narrative.

Here's the breakdown of common adjustments that you'll often come across in your financial statement adjustments and EBITDA fine-tuning:

- One-time events/Extraordinary items: These are the black swans of your financial statement, unexpected guests like the COVID effect, inflation spikes, or the aftermath of a spin-off/acquisition. By adjusting for these, you're essentially saying, "This isn't part of our regular programming."

- Non-core business adjustments: Sometimes a business strays from its usual path – it could be a restructuring expense, sale of fixed assets, or discontinued operations. Adjusting for these helps to keep the focus on your business's main act.

- Parent company vs. local statutory account adjustments: When your business speaks in multiple financial dialects, adjustments help ensure everyone is singing from the same hymn sheet, particularly during financial consolidation.

- Allowance for Bad Debts: Your business might be a rock star, but not all fans will pay up for the concert tickets. Estimating and recording a provision for doubtful accounts receivable helps keep your financial statements realistic and grounded.

- Inventory Valuation adjustments: Sometimes, you have to accept that some of your inventory may not be as valuable as it once was. Adjusting inventory values to the lower of cost or net realizable value keeps your balance sheet honest and trustworthy. You can use our free Inventory tracking report template for Excel to help identify potential adjustments.

- Contingent Liabilities adjustments: Potential liabilities from pending lawsuits, warranties, or other uncertain events need to be taken into account. It's a bit like factoring in a chance of rain when planning a picnic.

- Fair Value Adjustments: These adjustments ensure that financial assets or liabilities are valued at their current market value, providing a truthful picture of the business's financial standing.

- Revenue Recognition adjustments: This one ensures that revenue is recognized when it is earned, not when the cash rolls in. It may involve adjusting for unearned revenue or recognizing revenue from long-term contracts over time.

- Income Tax Provision adjustments: These adjustments account for current and deferred income taxes based on applicable tax laws and regulations. It's about playing by the tax man's rules.

Every adjustment helps to create a more accurate, more representative picture of your financial performance. It’s all about giving your financial statement the right stage to truly shine and reveal your business's true financial narrative.

How to do it in Excel

Adjusting financial statements might seem like cracking a secret code, but with the right guidance and a dash of Excel magic, it can be as straightforward as a Sunday afternoon crossword puzzle. So let's get cracking!

Want to adjust your EBITDA and/or income statement as fast as possible? Download these templates, enter your data, and you're all set.

1. Acquire your Source Material

You'll need your statutory financial statements (income statement, balance sheet or cash flow) as the starting point. This is the rough diamond from which your polished gem of adjusted financial statements will emerge.

2. Identify Potential Adjustments

Put on your investigator cap and identify elements that require adjustments. This could range from one-time events to inventory valuation.

3. Calculate Adjusted Financial Statements

Now comes the fun part! Apply your adjustments to your source statements. Remember, expenses should be adjusted in the opposite direction to income - like a financial yin and yang.

4. Analyze and Make Decisions

Time to revel in the fruits of your labor. Dive into your adjusted financial statements, extract insights, and use them to make informed, strategic decisions. You've just turned a mountain of data into a goldmine of knowledge.

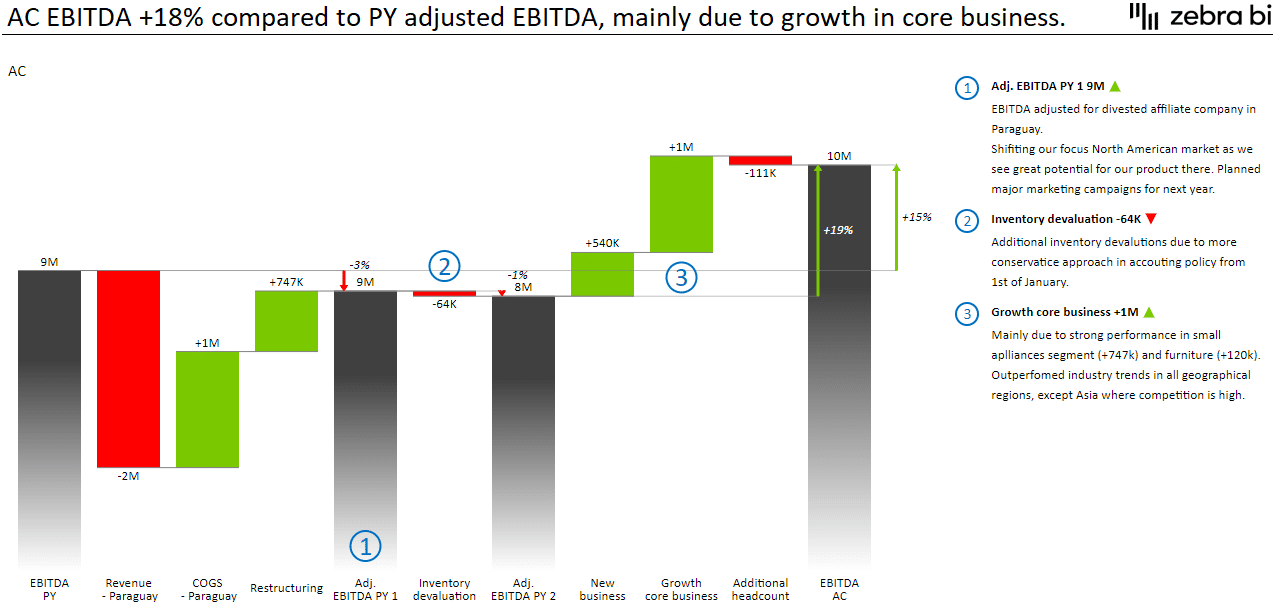

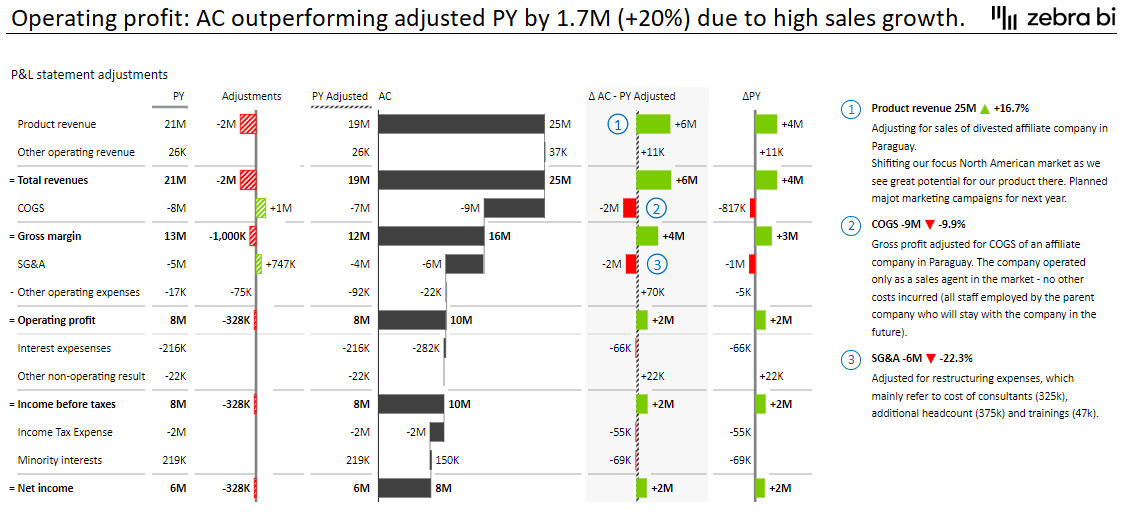

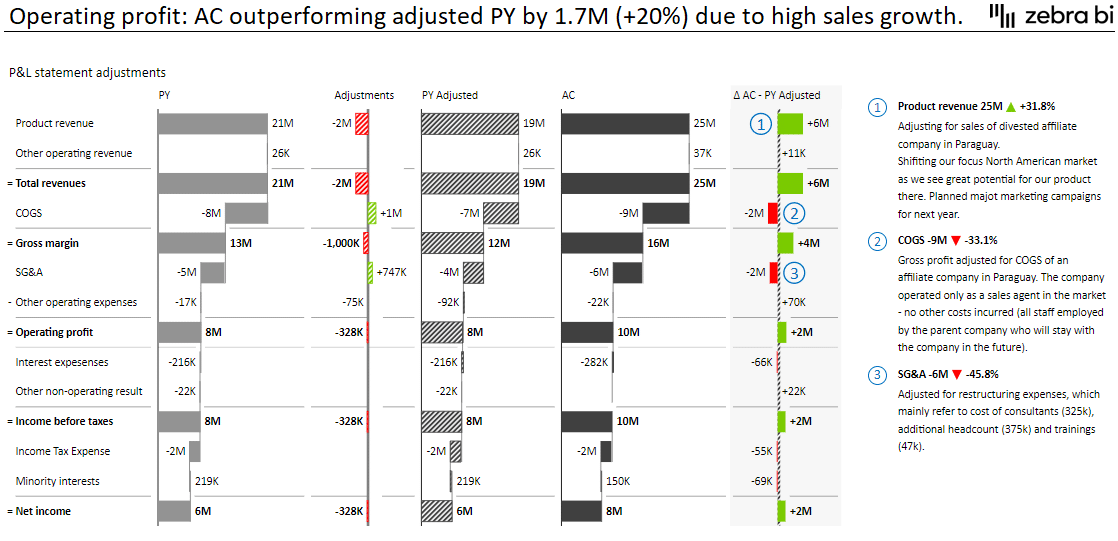

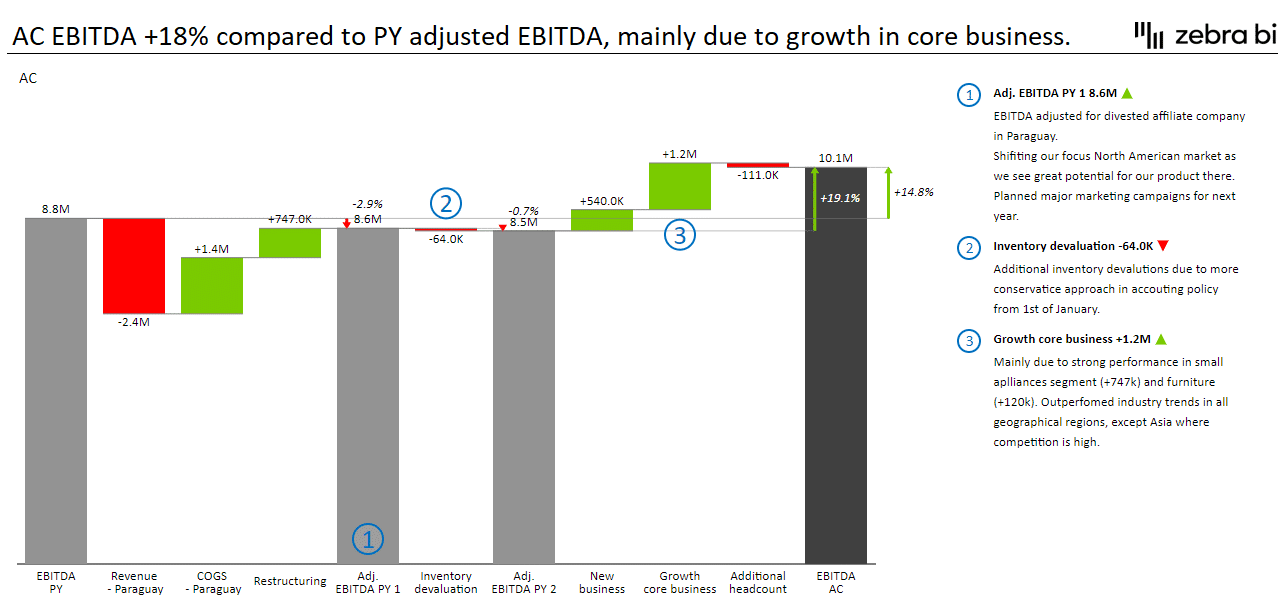

5. Present Your Adjustments with Zebra BI

Now that you've conquered the adjustment process, showcase it to your team and stakeholders using Zebra BI. It is IBCS-compliant out of the box. And the icing on the cake? You can illustrate the journey from EBITDA to adjusted EBITDA using a waterfall chart, with zero effort. Visual storytelling at its best!

Have a look at how easy it is:

And there you have it! A step-by-step guide to adjusting financial statements in Excel, turning you into a true financial statement superhero. Excel-lent job!

Elevate Your Financial Adjustments with Zebra BI

Unlock the true power of your financial adjustments with Zebra BI for Excel. Uncover insights, impress stakeholders, and simplify your financial reporting journey, try it out for FREE,

September 8th

September 8th February 22nd

February 22nd